#pip install yfinanceTopics in Quantitative Finance, Summer 2025

Lecture 5: Volatility and volatility-linked derivatives

\[ \newcommand{\bea}{\begin{eqnarray}} \newcommand{\eea}{\end{eqnarray}} \newcommand{\supp}{\mathrm{supp}} \newcommand{\F}{\mathcal{F} } \newcommand{\cF}{\mathcal{F} } \newcommand{\E}{\mathbb{E} } \newcommand{\Eof}[1]{\mathbb{E}\left[ #1 \right]} \newcommand{\Etof}[1]{\mathbb{E}_t\left[ #1 \right]} \def\Cov{{ \text{Cov} }} \def\ES{{ \text{ES} }} \def\Var{{ \text{Var} }} \def\VaR{{ \text{VaR} }} \def\sd{{ \text{sd} }} \def\corr{{ \text{corr} }} \newcommand{\1}{\mathbf{1} } \newcommand{\p}{\partial} \newcommand{\PP}{\mathbb{P} } \newcommand{\Pof}[1]{\mathbb{P}\left[ #1 \right]} \newcommand{\QQ}{\mathbb{Q} } \renewcommand{\R}{\mathbb{R} } \newcommand{\DD}{\mathbb{D} } \newcommand{\HH}{\mathbb{H} } \newcommand{\spn}{\mathrm{span} } \newcommand{\cov}{\mathrm{cov} } \newcommand{\HS}{\mathcal{L}_{\mathrm{HS}} } \newcommand{\Hess}{\mathrm{Hess} } \newcommand{\trace}{\mathrm{trace} } \newcommand{\LL}{\mathcal{L} } \newcommand{\s}{\mathcal{S} } \newcommand{\ee}{\mathcal{E} } \newcommand{\ff}{\mathcal{F} } \newcommand{\hh}{\mathcal{H} } \newcommand{\bb}{\mathcal{B} } \newcommand{\dd}{\mathcal{D} } \newcommand{\g}{\mathcal{G} } \newcommand{\half}{\frac{1}{2} } \newcommand{\T}{\mathcal{T} } \newcommand{\bit}{\begin{itemize}} \newcommand{\eit}{\end{itemize}} \newcommand{\beq}{\begin{equation}} \newcommand{\eeq}{\end{equation}} \newcommand{\tr}{\text{tr}} \renewcommand{\angl}[1]{\langle #1 \rangle} \]

Agenda

- Volatility and its various estimators

- Historical volatility

- Implied volatility

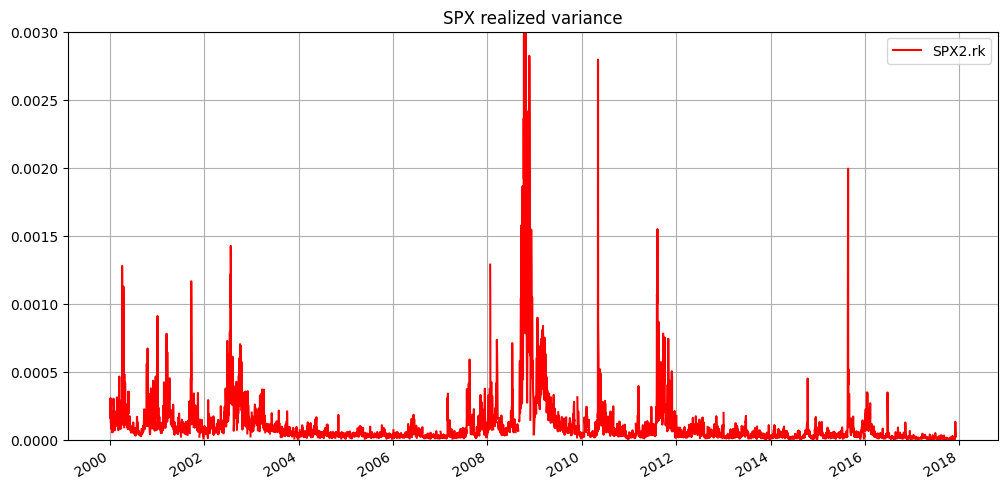

- Realized variance

- VIX

- Implied volatility

- Estimating discount factor and dividend rates by put-call parity

- GPR fit of implied volatilities

- Volatility indices published by CBOE

- Volatility linked derivatives

- VIX option

- Appendix (Optional)

- Realized variance from high frequency data

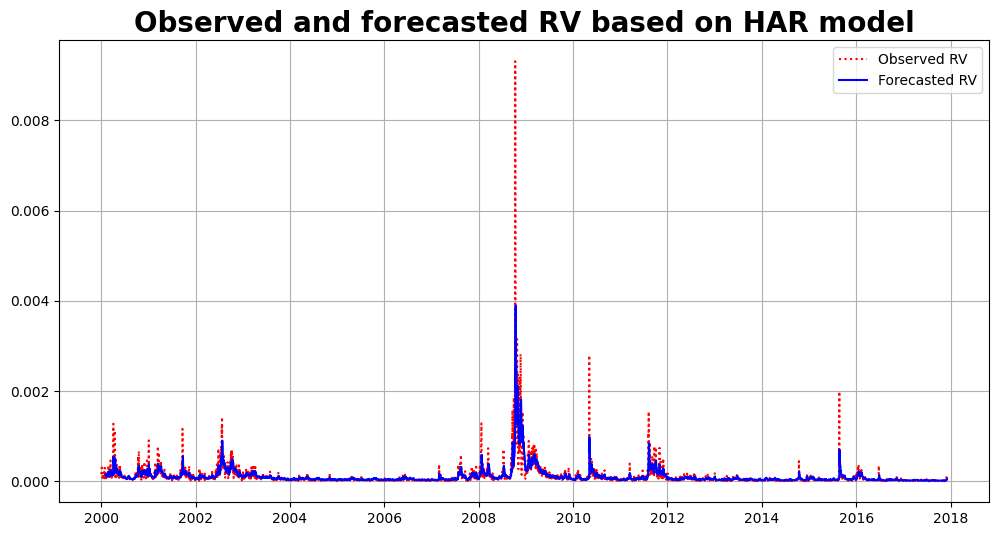

- The Corsi HAR-RV forecast

What is volatility?

From the Wikipage:

In finance, volatility (symbol \(\sigma\)) is the degree of variation of a trading price series over time as measured by the standard deviation of logarithmic returns.

- Historic volatility measures a time series of past market prices.

- Implied volatility looks forward in time, being derived from the market price of a market-traded derivative (in particular, an option).

- Realized variance estimates the integrated variance or quadratic variation by using high frequency data.

注: 波动率是金融资产价格的波动程度.

Why is volatility important?

From the same Wikipage:

Investors care about volatility for at least the following reasons:

The wider the swings in an investment’s price, the harder emotionally it is to not worry;

Price volatility of a trading instrument can define position sizing in a portfolio;

When certain cash flows from selling a security are needed at a specific future date, higher volatility means a greater chance of a shortfall;

Higher volatility of returns while saving for retirement results in a wider distribution of possible final portfolio values;

Higher volatility of return when retired gives withdrawals a larger permanent impact on the portfolio’s value;

Price volatility presents opportunities to buy assets cheaply and sell when overpriced;

Portfolio volatility has a negative impact on the compound annual growth rate (CAGR) of that portfolio

Volatility affects pricing of options, being a parameter of the Black–Scholes model.

In today’s markets, it is also possible to trade volatility directly, through the use of derivative securities such as options and variance swaps.

Volatilities

Volatility of a financial asset in its most preliminary form is defined as the (conditional) standard deviation of its log return. In practice, there exist various notions of “volatility” that are commonly used including

- Historical volatility (历史波动率)

- Realized and integrated variance/volatility (实际波动率, 一个理论上的, 无法被计算的值)

- Implied volatility (隐含波动率, 隐含波动率是制期权市场投资者在进行期权交易时对实际波动率的认识)

- Instantaneous volatility (瞬时波动率)

and methods of inferring these volatilities respectively from

- Daily or high-frequency time series data of the underlying

- Price series of variance swap

- Prices of liquidly traded vanilla options

Daily closing prices \(S_t\): \(S_0, S_1, S_2, ..., S_T\).

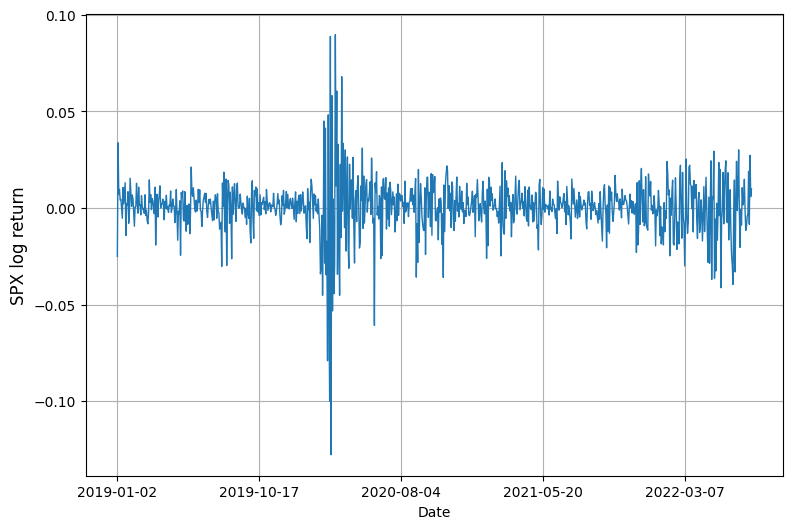

Log return \(\displaystyle r_t = \log (S_t/S_{t-1})\).

Then the daily volatility is defined as: \[ \sigma_t = \sqrt{\Eof{r_t^2}} = \sqrt{\Eof{\left(\log S_t/S_{t-1}\right)^2}}. \]

And the annualized volatility is defined as: \[ \sigma_t^{\text{annualized}} = \sqrt{252} \cdot \sigma_t. \]

The constant \(\sqrt{252}\) is used to convert the daily volatility to annualized volatility, assuming there are 252 trading days in a year.

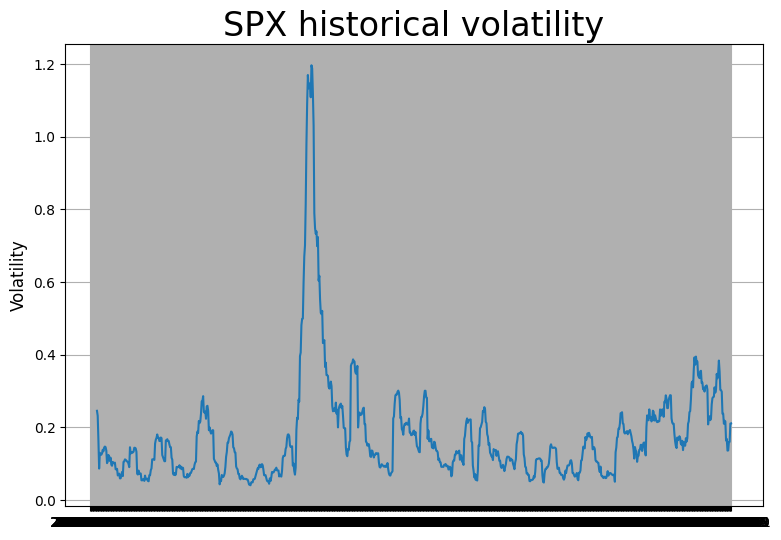

Historical volatility

Historical volatility uses, say daily, price series to calculate the sample conditional standard deviation of log returns in rolling time windows of a prespecified width.

Example of historical volatility

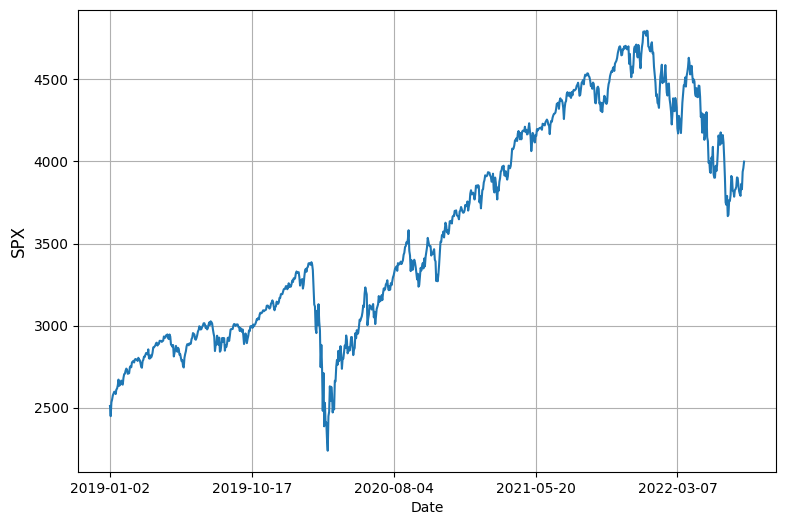

Now let’s calculate the volatility of S&P500 using 25-day rolling time windows.

One can calculate the volatility series of the input price series \(S_t\), \(1 \leq t \leq T\), by the following formula

\[ \sigma_t = \sqrt{\frac N{n-2}\sum_{i=1}^{n-1} (r_i - \bar r)^2}, \quad \text{ for } n \leq t \leq T, \]

where

\[\begin{aligned} r_i &= \ln S_{t + i} - \ln S_{t + i - 1}, \quad \text{for } 1 \leq i \leq n - 1, \\ \bar{r} &= \frac{1}{n-1} \sum_{i=1}^{n-1} r_i. \end{aligned}\]Note

- \(n\) denotes the width (number of days) of rolling window

- \(N\) denotes the number of days in a year, thus \(\sqrt N\) is the annualized factor

- The first \(n-1\) points in the output volatility series appear as NA, for an obvious reason.

Exponentially weighted moving average (EWMA)

An alternative to calculate historical volatility is the exponentially weighted moving average method.

\[ \sigma_t = \sqrt{N(1 - \lambda)\sum_{i=1}^{\infty} \lambda^i (r_{t - i} - \bar r)^2}, \quad \text{ for } n \leq t \leq T, \]

for some \(\lambda \in (0, 1)\).

Now let’s dirty our hands …

注: SPX stands for S&P 500 index, which is a stock market index that measures the stock performance of 500 large companies listed on stock exchanges in the United States.

import yfinance as yfimport numpy as np

from numpy import exp, log, sqrt

import scipy.stats as ss

from scipy.stats import norm

import pandas as pd

import yfinance as yf

import matplotlib.pyplot as plt

import statsmodels.formula.api as smTips: You may skip the next 5 cells if you encounter an error.

import os

proxy = 'http://127.0.0.1:7897'

os.environ['HTTP_PROXY'] = proxy

os.environ['HTTPS_PROXY'] = proxystart, end = '2019-01-01', '2024-07-24'

# download SPX from yahoo finance

spx = yf.Ticker("^GSPC").history(start=start, end=end)# brief look at the data

spx.info(), spx.isna().sum()<class 'pandas.core.frame.DataFrame'>

DatetimeIndex: 1398 entries, 2019-01-02 00:00:00-05:00 to 2024-07-23 00:00:00-04:00

Data columns (total 7 columns):

# Column Non-Null Count Dtype

--- ------ -------------- -----

0 Open 1398 non-null float64

1 High 1398 non-null float64

2 Low 1398 non-null float64

3 Close 1398 non-null float64

4 Volume 1398 non-null int64

5 Dividends 1398 non-null float64

6 Stock Splits 1398 non-null float64

dtypes: float64(6), int64(1)

memory usage: 87.4 KB(None,

Open 0

High 0

Low 0

Close 0

Volume 0

Dividends 0

Stock Splits 0

dtype: int64)# first and last few rows of the data

spx| Open | High | Low | Close | Volume | Dividends | Stock Splits | |

|---|---|---|---|---|---|---|---|

| Date | |||||||

| 2019-01-02 00:00:00-05:00 | 2476.959961 | 2519.489990 | 2467.469971 | 2510.030029 | 3733160000 | 0.0 | 0.0 |

| 2019-01-03 00:00:00-05:00 | 2491.919922 | 2493.139893 | 2443.959961 | 2447.889893 | 3858830000 | 0.0 | 0.0 |

| 2019-01-04 00:00:00-05:00 | 2474.330078 | 2538.070068 | 2474.330078 | 2531.939941 | 4234140000 | 0.0 | 0.0 |

| 2019-01-07 00:00:00-05:00 | 2535.610107 | 2566.159912 | 2524.560059 | 2549.689941 | 4133120000 | 0.0 | 0.0 |

| 2019-01-08 00:00:00-05:00 | 2568.110107 | 2579.820068 | 2547.560059 | 2574.409912 | 4120060000 | 0.0 | 0.0 |

| ... | ... | ... | ... | ... | ... | ... | ... |

| 2024-07-17 00:00:00-04:00 | 5610.069824 | 5622.490234 | 5584.810059 | 5588.270020 | 4246450000 | 0.0 | 0.0 |

| 2024-07-18 00:00:00-04:00 | 5608.560059 | 5614.049805 | 5522.810059 | 5544.589844 | 4007510000 | 0.0 | 0.0 |

| 2024-07-19 00:00:00-04:00 | 5543.370117 | 5557.500000 | 5497.040039 | 5505.000000 | 3760570000 | 0.0 | 0.0 |

| 2024-07-22 00:00:00-04:00 | 5544.540039 | 5570.359863 | 5529.040039 | 5564.410156 | 3375180000 | 0.0 | 0.0 |

| 2024-07-23 00:00:00-04:00 | 5565.299805 | 5585.339844 | 5550.899902 | 5555.740234 | 3500210000 | 0.0 | 0.0 |

1398 rows × 7 columns

# save data, just in case

# spx.to_csv('spx_07252022.csv')You may start from here.

# load saved data

spx = pd.read_csv('spx_07252022.csv')

spx.index = spx['Date']

spx = spx.drop('Date', axis=1)# summary statistics

spx.describe().transpose()| count | mean | std | min | 25% | 50% | 75% | max | |

|---|---|---|---|---|---|---|---|---|

| Open | 895.0 | 3.586641e+03 | 6.613510e+02 | 2290.709961 | 2.980045e+03 | 3.439380e+03 | 4.213645e+03 | 4.804510e+03 |

| High | 895.0 | 3.608340e+03 | 6.637349e+02 | 2300.729980 | 2.991620e+03 | 3.464860e+03 | 4.239375e+03 | 4.818620e+03 |

| Low | 895.0 | 3.562902e+03 | 6.583530e+02 | 2191.860107 | 2.963575e+03 | 3.419930e+03 | 4.192340e+03 | 4.780040e+03 |

| Close | 895.0 | 3.587314e+03 | 6.608265e+02 | 2237.399902 | 2.978570e+03 | 3.443120e+03 | 4.209795e+03 | 4.796560e+03 |

| Adj Close | 895.0 | 3.587314e+03 | 6.608265e+02 | 2237.399902 | 2.978570e+03 | 3.443120e+03 | 4.209795e+03 | 4.796560e+03 |

| Volume | 895.0 | 4.069480e+09 | 1.168092e+09 | 0.000000 | 3.337885e+09 | 3.778890e+09 | 4.548675e+09 | 9.878040e+09 |

# plot spx adjusted close

plt.figure(figsize=(9, 6))

spx['Close'].plot()

plt.ylabel('SPX', fontsize=12)

plt.grid();

# log return of spx

r = log(spx['Close']).diff()

# historical volatility in this period

vol = r.std()*sqrt(252)

r, r.mean(), vol, type(r)(Date

2019-01-02 NaN

2019-01-03 -0.025068

2019-01-04 0.033759

2019-01-07 0.006986

2019-01-08 0.009649

...

2022-07-15 0.019019

2022-07-18 -0.008399

2022-07-19 0.027254

2022-07-20 0.005878

2022-07-21 0.009813

Name: Close, Length: 895, dtype: float64,

0.0005209587220526575,

0.22945020327258875,

pandas.core.series.Series)# plot log return

plt.figure(figsize=(9, 6))

r.plot(lw=1)

plt.ylabel('SPX log return', fontsize=12)

plt.grid();

r.iloc[0:10], r.iloc[-10:](Date

2019-01-02 NaN

2019-01-03 -0.025068

2019-01-04 0.033759

2019-01-07 0.006986

2019-01-08 0.009649

2019-01-09 0.004090

2019-01-10 0.004508

2019-01-11 -0.000146

2019-01-14 -0.005271

2019-01-15 0.010665

Name: Close, dtype: float64,

Date

2022-07-08 -0.000831

2022-07-11 -0.011594

2022-07-12 -0.009287

2022-07-13 -0.004467

2022-07-14 -0.003003

2022-07-15 0.019019

2022-07-18 -0.008399

2022-07-19 0.027254

2022-07-20 0.005878

2022-07-21 0.009813

Name: Close, dtype: float64)# n: rwidth of rolling window

# N: annualizing factor

def volatility(data, n=10, N=252):

data = pd.Series(data)

vol = [np.nan for i in range(n)]

for i in range(len(data)-n):

vol += [data.iloc[i:(i+n)].std()*sqrt(N)]

return pd.DataFrame({'volatility': vol})volatility(r)| volatility | |

|---|---|

| 0 | NaN |

| 1 | NaN |

| 2 | NaN |

| 3 | NaN |

| 4 | NaN |

| ... | ... |

| 890 | 0.136786 |

| 891 | 0.160218 |

| 892 | 0.160347 |

| 893 | 0.210679 |

| 894 | 0.211261 |

895 rows × 1 columns

spx_vol = volatility(r)

spx_vol.index = r.index

plt.figure(figsize=(9, 6))

plt.plot(spx_vol)

plt.ylabel('Volatility', fontsize=12)

plt.title('SPX historical volatility', fontsize=24)

plt.grid();

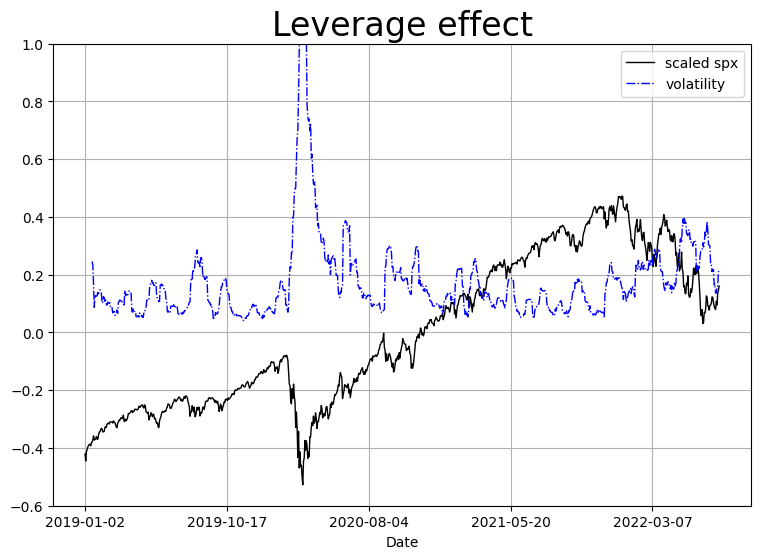

# leverage effect

spx_scaled = (spx - spx.mean())/(spx.max() - spx.min())

plt.figure(figsize=(9, 6))

spx_scaled['Close'].plot(color='k', lw=1, label='scaled spx')

plt.ylim([-0.6, 1])

plt.plot(spx_vol, 'b-.', lw=1, label='volatility')

plt.grid()

plt.title('Leverage effect', fontsize=24)

plt.legend();

注: Leverage effect (杠杆效应): Stock price 下降, Volatility 上升. Stock price 上升, Volatility 下降.

Equity index returns interact negatively with return volatilities.

Carr, Peter, and Liuren Wu. “Leverage Effect, Volatility Feedback, and Self-Exciting Market Disruptions.” The Journal of Financial and Quantitative Analysis, vol. 52, no. 5, 2017, pp. 2119–56. JSTOR, https://www.jstor.org/stable/26590473. Accessed 28 July 2025.

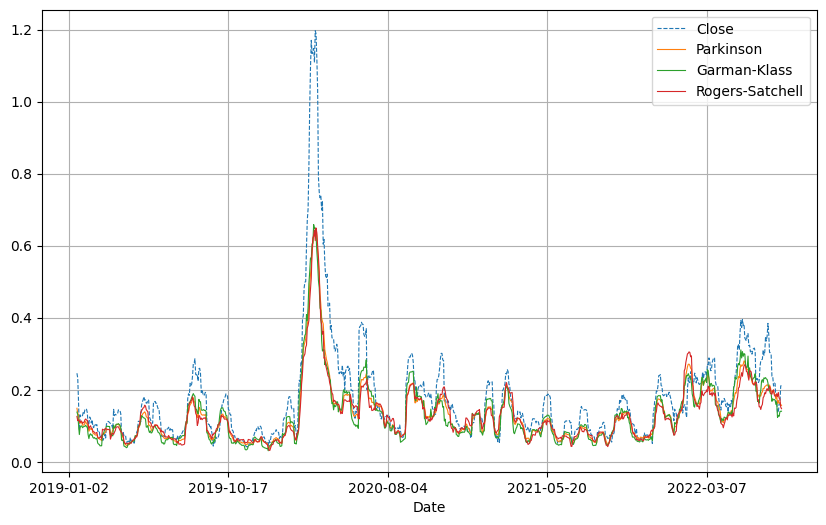

Volatility estimation using OHLC

- Parkison

- Garman-Klass

- Rogers-Satchell

- Yang-Zhang

- \(u_i = \ln H_i - \ln O_i\): daily high weighted by open,

- \(d_i = \ln L_i - \ln O_i\): daily low weighted by open

- \(o_i = \ln O_i - \ln C_{i-1}\)

- \(c_i = \ln C_i - \ln O_i\)

We make the calculation of these volatilties into a python class.

class Volatilities:

def __init__(self, OHLC, n=10, N=252):

self.n = n

self.N = N

self.OHLC = pd.DataFrame(OHLC)

self.o = self.OHLC.Open

self.h = self.OHLC.High

self.l = self.OHLC.Low

self.c = self.OHLC.Close

self.r = log(self.OHLC['Close']).diff()

self.vols_c = [np.nan for i in range(self.n)]

self.vols_p = [np.nan for i in range(self.n)]

self.vols_gk = [np.nan for i in range(self.n)]

self.vols_rs = [np.nan for i in range(self.n)]

for i in range(len(self.r) - self.n):

self.vols_c += [self.r.iloc[i:(i+self.n)].std()*sqrt(self.N)]

self.vols_p += [self.cal_vol_p(self.h.iloc[i:(i+self.n)], self.l.iloc[i:(i+self.n)])*sqrt(self.N)]

self.vols_gk += [self.cal_vol_gk(self.o.iloc[i:(i+self.n)], self.h.iloc[i:(i+self.n)], self.l.iloc[i:(i+self.n)], self.c.iloc[i:(i+self.n)])*sqrt(self.N)]

self.vols_rs += [self.cal_vol_rs(self.o.iloc[i:(i+self.n)], self.h.iloc[i:(i+self.n)], self.l.iloc[i:(i+self.n)], self.c.iloc[i:(i+self.n)])*sqrt(self.N)]

self.vols = pd.DataFrame({'close': self.vols_c, 'parkinson': self.vols_p, 'garman-klass': self.vols_gk, 'rogers-satchell': self.vols_rs})

self.vols.index = self.OHLC.index

def cal_vol_p(self, H, L):

return np.sqrt(((log(H) - log(L))**2).mean()/log(2)/4)

def cal_vol_gk(self, O, H, L, C):

term1 = ((log(H) - log(L))**2).mean()/2

term2 = (2*log(2) - 1)*((log(C) - log(O))**2).mean()

return np.sqrt(term1 - term2)

def cal_vol_rs(self, O, H, L, C):

u, d, c = log(H) - log(O), log(L) - log(O), log(C) - log(O)

return np.sqrt((u*(u-c)).mean() + (d*(d-c)).mean())%%time

spx_vols = Volatilities(spx)CPU times: total: 344 ms

Wall time: 1.69 sspx_vols.vols['garman-klass']Date

2019-01-02 NaN

2019-01-03 NaN

2019-01-04 NaN

2019-01-07 NaN

2019-01-08 NaN

...

2022-07-15 0.128716

2022-07-18 0.126178

2022-07-19 0.138915

2022-07-20 0.140416

2022-07-21 0.140299

Name: garman-klass, Length: 895, dtype: float64plt.figure(figsize=(10, 6))

spx_vols.vols['close'].plot(ls='--', label='Close', lw=0.8)

spx_vols.vols['parkinson'].plot(lw=0.8, label='Parkinson')

spx_vols.vols['garman-klass'].plot(lw=0.8, label='Garman-Klass')

spx_vols.vols['rogers-satchell'].plot(lw=0.8, label='Rogers-Satchell')

plt.legend()

plt.grid();

spx.tail(1)| Open | High | Low | Close | Adj Close | Volume | |

|---|---|---|---|---|---|---|

| Date | ||||||

| 2022-07-21 | 3955.469971 | 3999.290039 | 3927.639893 | 3998.949951 | 3998.949951 | 3586030000 |

Implied volatility

“A wrong number to a wrong formula for a correct answer.”

注: wrong number = volatility, wrong formula = Black-Scholes formula, correct answer = option price.

In the Black-Scholes model there is a one-to-one relation between the price of the option and the volatility parameter \(\sigma\). The option prices are often quoted by stating this specific volatility, called the implied volatility.

In Black-Scholes world, the volatility is assumed constant. But in reality, options of different strike require different volatilities to match their market prices. This is called the volatility smile.

Most of the work was inspired in modeling the implied volatility.

Why implied volatility rather than the price itself?

- Price of a call option is decreasing in strike and increasing in time to expiry

- Price of a far out-of-money option is small whereas price of a far in-the-money option carries mostly the intrinsic value

- Statistically speaking, implied volatility is a more standard quantity to infer

- Traders trade options in terms of implied volatilities rather than their prices

注:

- 期权价格本身不具备标准化, 不同期权之间不能直接比较; 但波动率是一个标准化的参数, 它不依赖 strike 或 expiry, 因此更便于比较.

- 期权价格的构成不一致, 有的主要是时间价值, 有的主要是内在价值; 隐含波动率剥离了内在价值, 只反映市场对未来波动的预期, 是一个更“干净”的指标.

- 你可以比较今天和昨天的隐含波动率来判断市场情绪变化; 但比较期权价格则可能受行权价、到期日等因素干扰.

注: 隐含波动率是市场通过期权的价格推导出的一种预期未来波动率, 它不代表过去的价格波动, 而是预测未来的价格波动区间. IV值高, 意味着市场认为未来价格波动较大; IV 值低, 则意味着市场预期未来波动较小.

期权的价格主要由四个因素决定: 标的资产价格、执行价格、到期时间和波动率. 隐含波动率是唯一一个通过市场价格间接估算出来的变量, 因此它在期权交易中的地位尤为特殊.

隐含波动率与期权价格呈正相关关系. 简单来说, IV 越高, 期权价格越高; IV越低, 期权价格越便宜. 这是因为高隐含波动率意味着标的资产未来可能出现较大的价格波动, 买方愿意为此支付更多的期权溢价, 而卖方则要求更高的补偿来承担风险.

隐含波动率没有固定的计算公式, 而是通过反推法, 根据期权定价模型 (如 Black-Scholes 模型) 和期权的市场价格来计算. 在实际交易中, 不同执行价的期权隐含波动率常呈现“微笑”或“倾斜”的形态, 这种现象被称为“波动率微笑 (Volatility Smile)”.

深度虚值期权 (OTM) 和深度实值期权 (ITM) 的 IV 通常较高, 因为这些期权受到极端价格变动的影响更大. 平值期权 (ATM) 的IV较低, 因为它更接近当前市场价格, 波动性风险相对较小.

A practical tip for fetching risk free and dividend rates

Q: How to obtain the interest rate \(r\) and dividend rate \(d\) for the calculation of implied volatility?

A: Put-call parity.

Recall the Put-Call Parity for European options

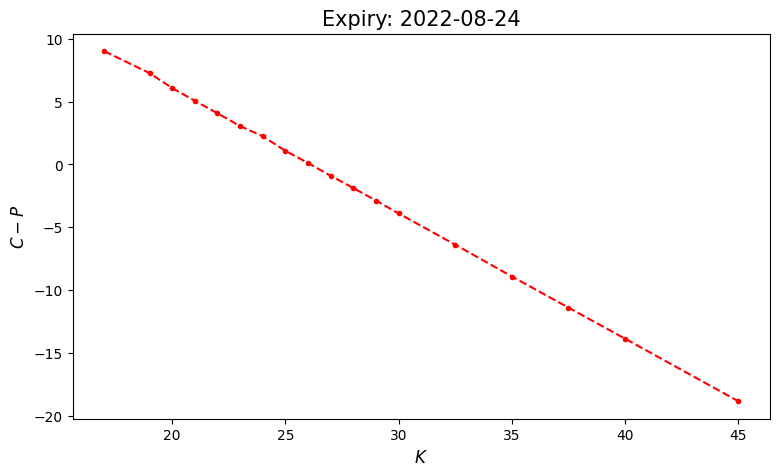

\[ C - P = Se^{-dT} - K e^{-rT} = e^{-rT} (F - K), \]

where \(F\) denotes the forward price of the underlying. Hence, if we regress \(C - P\) against \(K\), the (negative) slope gives us the discount factor and the intercept gives the ex-dividend underlying.

\(F = S e^{-(d-r)T}\), which means we can get the dividend rate \(d\) by the intercept \(F\).

Example - Implied volatilities of options on SPX

# import required modules

import datetime

from datetime import datetime as dt

import numpy as np

from numpy import exp, log, sqrt

import scipy.stats as ss

from scipy.stats import norm

import pandas as pd

import yfinance as yf

import matplotlib.pyplot as plt

import statsmodels.formula.api as smTips: You may skip the next 12 cells if you encounter an error.

# download spx options data from yahoo finance

spx = yf.Ticker('^SPX')

spx_expiries = spx.options

print(spx_expiries)('2025-07-28', '2025-07-29', '2025-07-30', '2025-07-31', '2025-08-01', '2025-08-04', '2025-08-05', '2025-08-06', '2025-08-07', '2025-08-08', '2025-08-11', '2025-08-12', '2025-08-13', '2025-08-14', '2025-08-15', '2025-08-18', '2025-08-19', '2025-08-20', '2025-08-21', '2025-08-22', '2025-08-25', '2025-08-26', '2025-08-27', '2025-08-28', '2025-08-29', '2025-09-02', '2025-09-05', '2025-09-08', '2025-09-12', '2025-09-19', '2025-09-30', '2025-10-17', '2025-10-31', '2025-11-21', '2025-11-28', '2025-12-19', '2025-12-31', '2026-01-16', '2026-02-20', '2026-03-20', '2026-03-31', '2026-04-17', '2026-05-15', '2026-06-18', '2026-06-30', '2026-07-17', '2026-08-21', '2026-09-18', '2026-12-18', '2027-06-17', '2027-12-17', '2028-12-15', '2029-12-21', '2030-12-20')# choose an expiry

idx = 17

today = dt.strftime(dt.now(), '%Y-%m-%d')

day_count = (dt.strptime(spx_expiries[idx], '%Y-%m-%d') - dt.now()).days

print(f'option expiry = {spx_expiries[idx]}, today = {today}')

print(f'There are {day_count} days to expiry')

option_chain = spx.option_chain(spx_expiries[idx])

spx_calls = option_chain.calls

spx_puts = option_chain.putsoption expiry = 2025-08-20, today = 2025-07-28

There are 22 days to expiryspx_calls.shape, spx_puts.shape((55, 14), (84, 14))spx_calls.info()<class 'pandas.core.frame.DataFrame'>

RangeIndex: 55 entries, 0 to 54

Data columns (total 14 columns):

# Column Non-Null Count Dtype

--- ------ -------------- -----

0 contractSymbol 55 non-null object

1 lastTradeDate 55 non-null datetime64[ns, UTC]

2 strike 55 non-null float64

3 lastPrice 55 non-null float64

4 bid 55 non-null float64

5 ask 55 non-null float64

6 change 55 non-null float64

7 percentChange 55 non-null float64

8 volume 38 non-null float64

9 openInterest 55 non-null int64

10 impliedVolatility 55 non-null float64

11 inTheMoney 55 non-null bool

12 contractSize 55 non-null object

13 currency 55 non-null object

dtypes: bool(1), datetime64[ns, UTC](1), float64(8), int64(1), object(3)

memory usage: 5.8+ KBspx_calls.isna().sum()contractSymbol 0

lastTradeDate 0

strike 0

lastPrice 0

bid 0

ask 0

change 0

percentChange 0

volume 17

openInterest 0

impliedVolatility 0

inTheMoney 0

contractSize 0

currency 0

dtype: int64spx_puts.isna().sum()contractSymbol 0

lastTradeDate 0

strike 0

lastPrice 0

bid 0

ask 0

change 0

percentChange 0

volume 19

openInterest 0

impliedVolatility 0

inTheMoney 0

contractSize 0

currency 0

dtype: int64spx_calls| contractSymbol | lastTradeDate | strike | lastPrice | bid | ask | change | percentChange | volume | openInterest | impliedVolatility | inTheMoney | contractSize | currency | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 0 | SPXW250820C05100000 | 2025-07-15 20:12:00+00:00 | 5100.0 | 1160.00 | 1327.3 | 1335.80 | 0.0 | 0.0 | NaN | 0 | 0.667568 | True | REGULAR | USD |

| 1 | SPXW250820C05200000 | 2025-07-16 13:33:29+00:00 | 5200.0 | 1080.00 | 1227.8 | 1236.30 | 0.0 | 0.0 | NaN | 0 | 0.625065 | True | REGULAR | USD |

| 2 | SPXW250820C05450000 | 2025-07-17 18:35:24+00:00 | 5450.0 | 873.00 | 979.4 | 987.90 | 0.0 | 0.0 | NaN | 0 | 0.520505 | True | REGULAR | USD |

| 3 | SPXW250820C05600000 | 2025-07-17 18:39:43+00:00 | 5600.0 | 725.75 | 830.6 | 839.10 | 0.0 | 0.0 | NaN | 0 | 0.471059 | True | REGULAR | USD |

| 4 | SPXW250820C06000000 | 2025-07-25 19:40:13+00:00 | 6000.0 | 419.54 | 438.2 | 446.60 | 0.0 | 0.0 | 1.0 | 0 | 0.305007 | True | REGULAR | USD |

| 5 | SPXW250820C06100000 | 2025-07-22 19:07:15+00:00 | 6100.0 | 263.17 | 342.9 | 351.70 | 0.0 | 0.0 | NaN | 0 | 0.265789 | True | REGULAR | USD |

| 6 | SPXW250820C06150000 | 2025-07-24 17:14:10+00:00 | 6150.0 | 267.38 | 296.7 | 305.40 | 0.0 | 0.0 | 2.0 | 0 | 0.246815 | True | REGULAR | USD |

| 7 | SPXW250820C06175000 | 2025-07-14 18:00:54+00:00 | 6175.0 | 186.31 | 273.7 | 282.50 | 0.0 | 0.0 | NaN | 0 | 0.237251 | True | REGULAR | USD |

| 8 | SPXW250820C06200000 | 2025-07-25 19:53:07+00:00 | 6200.0 | 232.41 | 251.6 | 260.00 | 0.0 | 0.0 | 33.0 | 0 | 0.227989 | True | REGULAR | USD |

| 9 | SPXW250820C06225000 | 2025-07-15 15:00:23+00:00 | 6225.0 | 147.87 | 228.9 | 237.90 | 0.0 | 0.0 | NaN | 0 | 0.218937 | True | REGULAR | USD |

| 10 | SPXW250820C06240000 | 2025-07-22 14:09:40+00:00 | 6240.0 | 141.65 | 215.9 | 224.80 | 0.0 | 0.0 | NaN | 0 | 0.213516 | True | REGULAR | USD |

| 11 | SPXW250820C06250000 | 2025-07-25 19:53:07+00:00 | 6250.0 | 189.71 | 210.5 | 213.40 | 0.0 | 0.0 | 33.0 | 0 | 0.205288 | True | REGULAR | USD |

| 12 | SPXW250820C06260000 | 2025-07-24 14:14:35+00:00 | 6260.0 | 164.55 | 202.2 | 204.80 | 0.0 | 0.0 | NaN | 0 | 0.201723 | True | REGULAR | USD |

| 13 | SPXW250820C06270000 | 2025-07-24 14:14:35+00:00 | 6270.0 | 156.70 | 193.7 | 196.30 | 0.0 | 0.0 | NaN | 0 | 0.198216 | True | REGULAR | USD |

| 14 | SPXW250820C06275000 | 2025-07-23 19:48:30+00:00 | 6275.0 | 147.30 | 189.2 | 192.10 | 0.0 | 0.0 | 6.0 | 0 | 0.196499 | True | REGULAR | USD |

| 15 | SPXW250820C06280000 | 2025-07-23 17:30:30+00:00 | 6280.0 | 135.77 | 185.2 | 187.90 | 0.0 | 0.0 | 26.0 | 0 | 0.194756 | True | REGULAR | USD |

| 16 | SPXW250820C06290000 | 2025-07-24 13:43:32+00:00 | 6290.0 | 141.60 | 176.7 | 179.60 | 0.0 | 0.0 | 1.0 | 0 | 0.191334 | True | REGULAR | USD |

| 17 | SPXW250820C06300000 | 2025-07-25 19:03:56+00:00 | 6300.0 | 151.55 | 168.5 | 171.40 | 0.0 | 0.0 | 4.0 | 0 | 0.187943 | True | REGULAR | USD |

| 18 | SPXW250820C06310000 | 2025-07-25 19:03:56+00:00 | 6310.0 | 143.79 | 160.4 | 163.30 | 0.0 | 0.0 | 1.0 | 0 | 0.184575 | True | REGULAR | USD |

| 19 | SPXW250820C06320000 | 2025-07-25 19:51:42+00:00 | 6320.0 | 134.47 | 153.4 | 154.20 | 0.0 | 0.0 | 1.0 | 0 | 0.179478 | True | REGULAR | USD |

| 20 | SPXW250820C06325000 | 2025-07-25 19:51:42+00:00 | 6325.0 | 130.77 | 149.4 | 150.30 | 0.0 | 0.0 | 5.0 | 0 | 0.177907 | True | REGULAR | USD |

| 21 | SPXW250820C06330000 | 2025-07-24 14:25:27+00:00 | 6330.0 | 114.00 | 145.6 | 146.40 | 0.0 | 0.0 | 40.0 | 0 | 0.176297 | True | REGULAR | USD |

| 22 | SPXW250820C06340000 | 2025-07-25 19:22:20+00:00 | 6340.0 | 123.00 | 137.8 | 138.70 | 0.0 | 0.0 | 40.0 | 0 | 0.173102 | True | REGULAR | USD |

| 23 | SPXW250820C06350000 | 2025-07-25 18:13:34+00:00 | 6350.0 | 114.81 | 130.2 | 131.10 | 0.0 | 0.0 | 15.0 | 0 | 0.169888 | True | REGULAR | USD |

| 24 | SPXW250820C06360000 | 2025-07-23 16:41:48+00:00 | 6360.0 | 82.10 | 122.8 | 123.60 | 0.0 | 0.0 | 2.0 | 0 | 0.166646 | True | REGULAR | USD |

| 25 | SPXW250820C06370000 | 2025-07-25 12:56:28+00:00 | 6370.0 | 89.09 | 115.6 | 116.40 | 0.0 | 0.0 | 1.0 | 0 | 0.163667 | True | REGULAR | USD |

| 26 | SPXW250820C06375000 | 2025-07-25 14:56:57+00:00 | 6375.0 | 87.15 | 112.0 | 112.90 | 0.0 | 0.0 | 4.0 | 0 | 0.162251 | True | REGULAR | USD |

| 27 | SPXW250820C06380000 | 2025-07-25 16:19:30+00:00 | 6380.0 | 87.71 | 108.5 | 109.40 | 0.0 | 0.0 | 80.0 | 0 | 0.160785 | True | REGULAR | USD |

| 28 | SPXW250820C06400000 | 2025-07-25 19:59:21+00:00 | 6400.0 | 79.20 | 94.9 | 95.80 | 0.0 | 0.0 | 2.0 | 0 | 0.154961 | False | REGULAR | USD |

| 29 | SPXW250820C06410000 | 2025-07-25 15:48:10+00:00 | 6410.0 | 67.17 | 88.4 | 89.30 | 0.0 | 0.0 | 1.0 | 0 | 0.152150 | False | REGULAR | USD |

| 30 | SPXW250820C06420000 | 2025-07-25 15:11:55+00:00 | 6420.0 | 62.95 | 82.2 | 83.10 | 0.0 | 0.0 | 36.0 | 0 | 0.149537 | False | REGULAR | USD |

| 31 | SPXW250820C06425000 | 2025-07-25 16:09:42+00:00 | 6425.0 | 60.34 | 79.2 | 80.10 | 0.0 | 0.0 | 11.0 | 0 | 0.148286 | False | REGULAR | USD |

| 32 | SPXW250820C06430000 | 2025-07-25 15:11:50+00:00 | 6430.0 | 57.88 | 76.2 | 77.10 | 0.0 | 0.0 | 18.0 | 0 | 0.146964 | False | REGULAR | USD |

| 33 | SPXW250820C06440000 | 2025-07-25 16:22:59+00:00 | 6440.0 | 54.59 | 70.5 | 71.30 | 0.0 | 0.0 | 4.0 | 0 | 0.144416 | False | REGULAR | USD |

| 34 | SPXW250820C06450000 | 2025-07-25 17:04:55+00:00 | 6450.0 | 52.55 | 65.1 | 65.90 | 0.0 | 0.0 | 39.0 | 0 | 0.142198 | False | REGULAR | USD |

| 35 | SPXW250820C06460000 | 2025-07-25 19:52:19+00:00 | 6460.0 | 49.20 | 59.8 | 60.60 | 0.0 | 0.0 | 3.0 | 0 | 0.139829 | False | REGULAR | USD |

| 36 | SPXW250820C06470000 | 2025-07-25 15:29:27+00:00 | 6470.0 | 40.74 | 54.9 | 55.70 | 0.0 | 0.0 | 5.0 | 0 | 0.137780 | False | REGULAR | USD |

| 37 | SPXW250820C06475000 | 2025-07-25 18:47:39+00:00 | 6475.0 | 45.30 | 52.4 | 53.30 | 0.0 | 0.0 | 71.0 | 0 | 0.136712 | False | REGULAR | USD |

| 38 | SPXW250820C06480000 | 2025-07-24 14:44:53+00:00 | 6480.0 | 37.38 | 50.2 | 51.00 | 0.0 | 0.0 | NaN | 0 | 0.135726 | False | REGULAR | USD |

| 39 | SPXW250820C06500000 | 2025-07-25 17:56:19+00:00 | 6500.0 | 34.52 | 41.7 | 42.40 | 0.0 | 0.0 | 7.0 | 0 | 0.131917 | False | REGULAR | USD |

| 40 | SPXW250820C06525000 | 2025-07-25 19:52:20+00:00 | 6525.0 | 26.10 | 32.5 | 33.10 | 0.0 | 0.0 | 50.0 | 0 | 0.127639 | False | REGULAR | USD |

| 41 | SPXW250820C06550000 | 2025-07-25 19:52:20+00:00 | 6550.0 | 19.80 | 24.9 | 25.50 | 0.0 | 0.0 | 14.0 | 0 | 0.124173 | False | REGULAR | USD |

| 42 | SPXW250820C06575000 | 2025-07-24 14:22:05+00:00 | 6575.0 | 13.00 | 18.7 | 19.30 | 0.0 | 0.0 | NaN | 0 | 0.121156 | False | REGULAR | USD |

| 43 | SPXW250820C06600000 | 2025-07-25 13:30:56+00:00 | 6600.0 | 9.30 | 13.9 | 14.50 | 0.0 | 0.0 | 1.0 | 0 | 0.118940 | False | REGULAR | USD |

| 44 | SPXW250820C06625000 | 2025-07-25 17:38:33+00:00 | 6625.0 | 8.40 | 10.1 | 10.70 | 0.0 | 0.0 | 5.0 | 0 | 0.116964 | False | REGULAR | USD |

| 45 | SPXW250820C06650000 | 2025-07-25 14:10:48+00:00 | 6650.0 | 5.00 | 7.3 | 7.70 | 0.0 | 0.0 | 4.0 | 0 | 0.114999 | False | REGULAR | USD |

| 46 | SPXW250820C06675000 | 2025-07-25 19:43:31+00:00 | 6675.0 | 4.20 | 5.1 | 5.60 | 0.0 | 0.0 | 2.0 | 0 | 0.114015 | False | REGULAR | USD |

| 47 | SPXW250820C06700000 | 2025-07-25 14:40:39+00:00 | 6700.0 | 2.70 | 3.6 | 4.10 | 0.0 | 0.0 | 5.0 | 0 | 0.113641 | False | REGULAR | USD |

| 48 | SPXW250820C06725000 | 2025-07-22 13:37:28+00:00 | 6725.0 | 1.97 | 2.6 | 2.95 | 0.0 | 0.0 | NaN | 0 | 0.113229 | False | REGULAR | USD |

| 49 | SPXW250820C06750000 | 2025-07-23 15:22:01+00:00 | 6750.0 | 1.30 | 1.9 | 2.15 | 0.0 | 0.0 | NaN | 0 | 0.113351 | False | REGULAR | USD |

| 50 | SPXW250820C06800000 | 2025-07-23 14:06:32+00:00 | 6800.0 | 0.82 | 0.0 | 1.30 | 0.0 | 0.0 | 1.0 | 0 | 0.116311 | False | REGULAR | USD |

| 51 | SPXW250820C06900000 | 2025-07-23 15:47:26+00:00 | 6900.0 | 0.45 | 0.0 | 0.00 | 0.0 | 0.0 | 6.0 | 0 | 0.062509 | False | REGULAR | USD |

| 52 | SPXW250820C07000000 | 2025-07-23 14:52:42+00:00 | 7000.0 | 0.25 | 0.0 | 0.00 | 0.0 | 0.0 | NaN | 0 | 0.062509 | False | REGULAR | USD |

| 53 | SPXW250820C07200000 | 2025-07-24 13:48:48+00:00 | 7200.0 | 0.25 | 0.0 | 0.00 | 0.0 | 0.0 | NaN | 0 | 0.062509 | False | REGULAR | USD |

| 54 | SPXW250820C08000000 | 2025-07-23 13:30:06+00:00 | 8000.0 | 0.05 | 0.0 | 0.00 | 0.0 | 0.0 | NaN | 0 | 0.125009 | False | REGULAR | USD |

# clean up data

# remove NA's

spx_calls = spx_calls.drop(['currency', 'contractSize'], axis=1).dropna()

spx_puts = spx_puts.drop(['currency', 'contractSize'], axis=1).dropna()

spx_calls.shape, spx_puts.shape((38, 12), (65, 12))spx_calls[spx_calls['lastTradeDate'] > '2024-07']| contractSymbol | lastTradeDate | strike | lastPrice | bid | ask | change | percentChange | volume | openInterest | impliedVolatility | inTheMoney | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 4 | SPXW250820C06000000 | 2025-07-25 19:40:13+00:00 | 6000.0 | 419.54 | 438.2 | 446.6 | 0.0 | 0.0 | 1.0 | 0 | 0.305007 | True |

| 6 | SPXW250820C06150000 | 2025-07-24 17:14:10+00:00 | 6150.0 | 267.38 | 296.7 | 305.4 | 0.0 | 0.0 | 2.0 | 0 | 0.246815 | True |

| 8 | SPXW250820C06200000 | 2025-07-25 19:53:07+00:00 | 6200.0 | 232.41 | 251.6 | 260.0 | 0.0 | 0.0 | 33.0 | 0 | 0.227989 | True |

| 11 | SPXW250820C06250000 | 2025-07-25 19:53:07+00:00 | 6250.0 | 189.71 | 210.5 | 213.4 | 0.0 | 0.0 | 33.0 | 0 | 0.205288 | True |

| 14 | SPXW250820C06275000 | 2025-07-23 19:48:30+00:00 | 6275.0 | 147.30 | 189.2 | 192.1 | 0.0 | 0.0 | 6.0 | 0 | 0.196499 | True |

| 15 | SPXW250820C06280000 | 2025-07-23 17:30:30+00:00 | 6280.0 | 135.77 | 185.2 | 187.9 | 0.0 | 0.0 | 26.0 | 0 | 0.194756 | True |

| 16 | SPXW250820C06290000 | 2025-07-24 13:43:32+00:00 | 6290.0 | 141.60 | 176.7 | 179.6 | 0.0 | 0.0 | 1.0 | 0 | 0.191334 | True |

| 17 | SPXW250820C06300000 | 2025-07-25 19:03:56+00:00 | 6300.0 | 151.55 | 168.5 | 171.4 | 0.0 | 0.0 | 4.0 | 0 | 0.187943 | True |

| 18 | SPXW250820C06310000 | 2025-07-25 19:03:56+00:00 | 6310.0 | 143.79 | 160.4 | 163.3 | 0.0 | 0.0 | 1.0 | 0 | 0.184575 | True |

| 19 | SPXW250820C06320000 | 2025-07-25 19:51:42+00:00 | 6320.0 | 134.47 | 153.4 | 154.2 | 0.0 | 0.0 | 1.0 | 0 | 0.179478 | True |

| 20 | SPXW250820C06325000 | 2025-07-25 19:51:42+00:00 | 6325.0 | 130.77 | 149.4 | 150.3 | 0.0 | 0.0 | 5.0 | 0 | 0.177907 | True |

| 21 | SPXW250820C06330000 | 2025-07-24 14:25:27+00:00 | 6330.0 | 114.00 | 145.6 | 146.4 | 0.0 | 0.0 | 40.0 | 0 | 0.176297 | True |

| 22 | SPXW250820C06340000 | 2025-07-25 19:22:20+00:00 | 6340.0 | 123.00 | 137.8 | 138.7 | 0.0 | 0.0 | 40.0 | 0 | 0.173102 | True |

| 23 | SPXW250820C06350000 | 2025-07-25 18:13:34+00:00 | 6350.0 | 114.81 | 130.2 | 131.1 | 0.0 | 0.0 | 15.0 | 0 | 0.169888 | True |

| 24 | SPXW250820C06360000 | 2025-07-23 16:41:48+00:00 | 6360.0 | 82.10 | 122.8 | 123.6 | 0.0 | 0.0 | 2.0 | 0 | 0.166646 | True |

| 25 | SPXW250820C06370000 | 2025-07-25 12:56:28+00:00 | 6370.0 | 89.09 | 115.6 | 116.4 | 0.0 | 0.0 | 1.0 | 0 | 0.163667 | True |

| 26 | SPXW250820C06375000 | 2025-07-25 14:56:57+00:00 | 6375.0 | 87.15 | 112.0 | 112.9 | 0.0 | 0.0 | 4.0 | 0 | 0.162251 | True |

| 27 | SPXW250820C06380000 | 2025-07-25 16:19:30+00:00 | 6380.0 | 87.71 | 108.5 | 109.4 | 0.0 | 0.0 | 80.0 | 0 | 0.160785 | True |

| 28 | SPXW250820C06400000 | 2025-07-25 19:59:21+00:00 | 6400.0 | 79.20 | 94.9 | 95.8 | 0.0 | 0.0 | 2.0 | 0 | 0.154961 | False |

| 29 | SPXW250820C06410000 | 2025-07-25 15:48:10+00:00 | 6410.0 | 67.17 | 88.4 | 89.3 | 0.0 | 0.0 | 1.0 | 0 | 0.152150 | False |

| 30 | SPXW250820C06420000 | 2025-07-25 15:11:55+00:00 | 6420.0 | 62.95 | 82.2 | 83.1 | 0.0 | 0.0 | 36.0 | 0 | 0.149537 | False |

| 31 | SPXW250820C06425000 | 2025-07-25 16:09:42+00:00 | 6425.0 | 60.34 | 79.2 | 80.1 | 0.0 | 0.0 | 11.0 | 0 | 0.148286 | False |

| 32 | SPXW250820C06430000 | 2025-07-25 15:11:50+00:00 | 6430.0 | 57.88 | 76.2 | 77.1 | 0.0 | 0.0 | 18.0 | 0 | 0.146964 | False |

| 33 | SPXW250820C06440000 | 2025-07-25 16:22:59+00:00 | 6440.0 | 54.59 | 70.5 | 71.3 | 0.0 | 0.0 | 4.0 | 0 | 0.144416 | False |

| 34 | SPXW250820C06450000 | 2025-07-25 17:04:55+00:00 | 6450.0 | 52.55 | 65.1 | 65.9 | 0.0 | 0.0 | 39.0 | 0 | 0.142198 | False |

| 35 | SPXW250820C06460000 | 2025-07-25 19:52:19+00:00 | 6460.0 | 49.20 | 59.8 | 60.6 | 0.0 | 0.0 | 3.0 | 0 | 0.139829 | False |

| 36 | SPXW250820C06470000 | 2025-07-25 15:29:27+00:00 | 6470.0 | 40.74 | 54.9 | 55.7 | 0.0 | 0.0 | 5.0 | 0 | 0.137780 | False |

| 37 | SPXW250820C06475000 | 2025-07-25 18:47:39+00:00 | 6475.0 | 45.30 | 52.4 | 53.3 | 0.0 | 0.0 | 71.0 | 0 | 0.136712 | False |

| 39 | SPXW250820C06500000 | 2025-07-25 17:56:19+00:00 | 6500.0 | 34.52 | 41.7 | 42.4 | 0.0 | 0.0 | 7.0 | 0 | 0.131917 | False |

| 40 | SPXW250820C06525000 | 2025-07-25 19:52:20+00:00 | 6525.0 | 26.10 | 32.5 | 33.1 | 0.0 | 0.0 | 50.0 | 0 | 0.127639 | False |

| 41 | SPXW250820C06550000 | 2025-07-25 19:52:20+00:00 | 6550.0 | 19.80 | 24.9 | 25.5 | 0.0 | 0.0 | 14.0 | 0 | 0.124173 | False |

| 43 | SPXW250820C06600000 | 2025-07-25 13:30:56+00:00 | 6600.0 | 9.30 | 13.9 | 14.5 | 0.0 | 0.0 | 1.0 | 0 | 0.118940 | False |

| 44 | SPXW250820C06625000 | 2025-07-25 17:38:33+00:00 | 6625.0 | 8.40 | 10.1 | 10.7 | 0.0 | 0.0 | 5.0 | 0 | 0.116964 | False |

| 45 | SPXW250820C06650000 | 2025-07-25 14:10:48+00:00 | 6650.0 | 5.00 | 7.3 | 7.7 | 0.0 | 0.0 | 4.0 | 0 | 0.114999 | False |

| 46 | SPXW250820C06675000 | 2025-07-25 19:43:31+00:00 | 6675.0 | 4.20 | 5.1 | 5.6 | 0.0 | 0.0 | 2.0 | 0 | 0.114015 | False |

| 47 | SPXW250820C06700000 | 2025-07-25 14:40:39+00:00 | 6700.0 | 2.70 | 3.6 | 4.1 | 0.0 | 0.0 | 5.0 | 0 | 0.113641 | False |

| 50 | SPXW250820C06800000 | 2025-07-23 14:06:32+00:00 | 6800.0 | 0.82 | 0.0 | 1.3 | 0.0 | 0.0 | 1.0 | 0 | 0.116311 | False |

| 51 | SPXW250820C06900000 | 2025-07-23 15:47:26+00:00 | 6900.0 | 0.45 | 0.0 | 0.0 | 0.0 | 0.0 | 6.0 | 0 | 0.062509 | False |

# remove data point where either bid = 0 or ask = 0

# remove data that that are not traded recently

spx_calls = spx_calls[(spx_calls['bid'] > 0) & (spx_calls['ask'] > 0)]

#spx_calls[spx_calls['lastTradeDate'] > '2022-07']

spx_calls| contractSymbol | lastTradeDate | strike | lastPrice | bid | ask | change | percentChange | volume | openInterest | impliedVolatility | inTheMoney | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 4 | SPXW250820C06000000 | 2025-07-25 19:40:13+00:00 | 6000.0 | 419.54 | 438.2 | 446.6 | 0.0 | 0.0 | 1.0 | 0 | 0.305007 | True |

| 6 | SPXW250820C06150000 | 2025-07-24 17:14:10+00:00 | 6150.0 | 267.38 | 296.7 | 305.4 | 0.0 | 0.0 | 2.0 | 0 | 0.246815 | True |

| 8 | SPXW250820C06200000 | 2025-07-25 19:53:07+00:00 | 6200.0 | 232.41 | 251.6 | 260.0 | 0.0 | 0.0 | 33.0 | 0 | 0.227989 | True |

| 11 | SPXW250820C06250000 | 2025-07-25 19:53:07+00:00 | 6250.0 | 189.71 | 210.5 | 213.4 | 0.0 | 0.0 | 33.0 | 0 | 0.205288 | True |

| 14 | SPXW250820C06275000 | 2025-07-23 19:48:30+00:00 | 6275.0 | 147.30 | 189.2 | 192.1 | 0.0 | 0.0 | 6.0 | 0 | 0.196499 | True |

| 15 | SPXW250820C06280000 | 2025-07-23 17:30:30+00:00 | 6280.0 | 135.77 | 185.2 | 187.9 | 0.0 | 0.0 | 26.0 | 0 | 0.194756 | True |

| 16 | SPXW250820C06290000 | 2025-07-24 13:43:32+00:00 | 6290.0 | 141.60 | 176.7 | 179.6 | 0.0 | 0.0 | 1.0 | 0 | 0.191334 | True |

| 17 | SPXW250820C06300000 | 2025-07-25 19:03:56+00:00 | 6300.0 | 151.55 | 168.5 | 171.4 | 0.0 | 0.0 | 4.0 | 0 | 0.187943 | True |

| 18 | SPXW250820C06310000 | 2025-07-25 19:03:56+00:00 | 6310.0 | 143.79 | 160.4 | 163.3 | 0.0 | 0.0 | 1.0 | 0 | 0.184575 | True |

| 19 | SPXW250820C06320000 | 2025-07-25 19:51:42+00:00 | 6320.0 | 134.47 | 153.4 | 154.2 | 0.0 | 0.0 | 1.0 | 0 | 0.179478 | True |

| 20 | SPXW250820C06325000 | 2025-07-25 19:51:42+00:00 | 6325.0 | 130.77 | 149.4 | 150.3 | 0.0 | 0.0 | 5.0 | 0 | 0.177907 | True |

| 21 | SPXW250820C06330000 | 2025-07-24 14:25:27+00:00 | 6330.0 | 114.00 | 145.6 | 146.4 | 0.0 | 0.0 | 40.0 | 0 | 0.176297 | True |

| 22 | SPXW250820C06340000 | 2025-07-25 19:22:20+00:00 | 6340.0 | 123.00 | 137.8 | 138.7 | 0.0 | 0.0 | 40.0 | 0 | 0.173102 | True |

| 23 | SPXW250820C06350000 | 2025-07-25 18:13:34+00:00 | 6350.0 | 114.81 | 130.2 | 131.1 | 0.0 | 0.0 | 15.0 | 0 | 0.169888 | True |

| 24 | SPXW250820C06360000 | 2025-07-23 16:41:48+00:00 | 6360.0 | 82.10 | 122.8 | 123.6 | 0.0 | 0.0 | 2.0 | 0 | 0.166646 | True |

| 25 | SPXW250820C06370000 | 2025-07-25 12:56:28+00:00 | 6370.0 | 89.09 | 115.6 | 116.4 | 0.0 | 0.0 | 1.0 | 0 | 0.163667 | True |

| 26 | SPXW250820C06375000 | 2025-07-25 14:56:57+00:00 | 6375.0 | 87.15 | 112.0 | 112.9 | 0.0 | 0.0 | 4.0 | 0 | 0.162251 | True |

| 27 | SPXW250820C06380000 | 2025-07-25 16:19:30+00:00 | 6380.0 | 87.71 | 108.5 | 109.4 | 0.0 | 0.0 | 80.0 | 0 | 0.160785 | True |

| 28 | SPXW250820C06400000 | 2025-07-25 19:59:21+00:00 | 6400.0 | 79.20 | 94.9 | 95.8 | 0.0 | 0.0 | 2.0 | 0 | 0.154961 | False |

| 29 | SPXW250820C06410000 | 2025-07-25 15:48:10+00:00 | 6410.0 | 67.17 | 88.4 | 89.3 | 0.0 | 0.0 | 1.0 | 0 | 0.152150 | False |

| 30 | SPXW250820C06420000 | 2025-07-25 15:11:55+00:00 | 6420.0 | 62.95 | 82.2 | 83.1 | 0.0 | 0.0 | 36.0 | 0 | 0.149537 | False |

| 31 | SPXW250820C06425000 | 2025-07-25 16:09:42+00:00 | 6425.0 | 60.34 | 79.2 | 80.1 | 0.0 | 0.0 | 11.0 | 0 | 0.148286 | False |

| 32 | SPXW250820C06430000 | 2025-07-25 15:11:50+00:00 | 6430.0 | 57.88 | 76.2 | 77.1 | 0.0 | 0.0 | 18.0 | 0 | 0.146964 | False |

| 33 | SPXW250820C06440000 | 2025-07-25 16:22:59+00:00 | 6440.0 | 54.59 | 70.5 | 71.3 | 0.0 | 0.0 | 4.0 | 0 | 0.144416 | False |

| 34 | SPXW250820C06450000 | 2025-07-25 17:04:55+00:00 | 6450.0 | 52.55 | 65.1 | 65.9 | 0.0 | 0.0 | 39.0 | 0 | 0.142198 | False |

| 35 | SPXW250820C06460000 | 2025-07-25 19:52:19+00:00 | 6460.0 | 49.20 | 59.8 | 60.6 | 0.0 | 0.0 | 3.0 | 0 | 0.139829 | False |

| 36 | SPXW250820C06470000 | 2025-07-25 15:29:27+00:00 | 6470.0 | 40.74 | 54.9 | 55.7 | 0.0 | 0.0 | 5.0 | 0 | 0.137780 | False |

| 37 | SPXW250820C06475000 | 2025-07-25 18:47:39+00:00 | 6475.0 | 45.30 | 52.4 | 53.3 | 0.0 | 0.0 | 71.0 | 0 | 0.136712 | False |

| 39 | SPXW250820C06500000 | 2025-07-25 17:56:19+00:00 | 6500.0 | 34.52 | 41.7 | 42.4 | 0.0 | 0.0 | 7.0 | 0 | 0.131917 | False |

| 40 | SPXW250820C06525000 | 2025-07-25 19:52:20+00:00 | 6525.0 | 26.10 | 32.5 | 33.1 | 0.0 | 0.0 | 50.0 | 0 | 0.127639 | False |

| 41 | SPXW250820C06550000 | 2025-07-25 19:52:20+00:00 | 6550.0 | 19.80 | 24.9 | 25.5 | 0.0 | 0.0 | 14.0 | 0 | 0.124173 | False |

| 43 | SPXW250820C06600000 | 2025-07-25 13:30:56+00:00 | 6600.0 | 9.30 | 13.9 | 14.5 | 0.0 | 0.0 | 1.0 | 0 | 0.118940 | False |

| 44 | SPXW250820C06625000 | 2025-07-25 17:38:33+00:00 | 6625.0 | 8.40 | 10.1 | 10.7 | 0.0 | 0.0 | 5.0 | 0 | 0.116964 | False |

| 45 | SPXW250820C06650000 | 2025-07-25 14:10:48+00:00 | 6650.0 | 5.00 | 7.3 | 7.7 | 0.0 | 0.0 | 4.0 | 0 | 0.114999 | False |

| 46 | SPXW250820C06675000 | 2025-07-25 19:43:31+00:00 | 6675.0 | 4.20 | 5.1 | 5.6 | 0.0 | 0.0 | 2.0 | 0 | 0.114015 | False |

| 47 | SPXW250820C06700000 | 2025-07-25 14:40:39+00:00 | 6700.0 | 2.70 | 3.6 | 4.1 | 0.0 | 0.0 | 5.0 | 0 | 0.113641 | False |

spx_puts = spx_puts[(spx_puts['bid'] > 0) & (spx_puts['ask'] > 0)]

#spx_puts = spx_puts[spx_puts['lastTradeDate'] > '2022-02']

spx_puts| contractSymbol | lastTradeDate | strike | lastPrice | bid | ask | change | percentChange | volume | openInterest | impliedVolatility | inTheMoney | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 6 | SPXW250820P04800000 | 2025-07-23 19:03:36+00:00 | 4800.0 | 1.55 | 0.70 | 0.90 | 0.000000 | 0.000000 | 23.0 | 0 | 0.429327 | False |

| 11 | SPXW250820P05400000 | 2025-07-25 19:37:03+00:00 | 5400.0 | 2.85 | 2.20 | 2.40 | 0.000000 | 0.000000 | 1.0 | 0 | 0.301795 | False |

| 12 | SPXW250820P05425000 | 2025-07-25 20:02:09+00:00 | 5425.0 | 2.80 | 2.30 | 2.50 | 0.000000 | 0.000000 | 1590.0 | 0 | 0.296272 | False |

| 13 | SPXW250820P05450000 | 2025-07-25 20:00:17+00:00 | 5450.0 | 3.00 | 2.40 | 2.60 | 0.000000 | 0.000000 | 4.0 | 0 | 0.290657 | False |

| 14 | SPXW250820P05500000 | 2025-07-25 20:00:51+00:00 | 5500.0 | 3.32 | 2.65 | 2.85 | 0.000000 | 0.000000 | 100.0 | 0 | 0.279884 | False |

| 17 | SPXW250820P05575000 | 2025-07-21 18:22:57+00:00 | 5575.0 | 6.30 | 3.00 | 3.30 | 0.000000 | 0.000000 | 25.0 | 0 | 0.263801 | False |

| 19 | SPXW250820P05625000 | 2025-07-25 19:45:59+00:00 | 5625.0 | 4.30 | 3.30 | 3.60 | 0.000000 | 0.000000 | 61.0 | 0 | 0.252449 | False |

| 21 | SPXW250820P05675000 | 2025-07-24 19:45:17+00:00 | 5675.0 | 5.10 | 3.70 | 4.00 | 0.000000 | 0.000000 | 1.0 | 0 | 0.241646 | False |

| 22 | SPXW250820P05700000 | 2025-07-24 20:08:32+00:00 | 5700.0 | 5.80 | 3.90 | 4.20 | 0.000000 | 0.000000 | 23.0 | 0 | 0.236031 | False |

| 24 | SPXW250820P05750000 | 2025-07-24 13:54:07+00:00 | 5750.0 | 6.00 | 4.30 | 4.70 | 0.000000 | 0.000000 | 72.0 | 0 | 0.225182 | False |

| 25 | SPXW250820P05775000 | 2025-07-23 18:05:17+00:00 | 5775.0 | 7.47 | 4.60 | 5.00 | 0.000000 | 0.000000 | 67.0 | 0 | 0.219902 | False |

| 26 | SPXW250820P05800000 | 2025-07-24 19:57:36+00:00 | 5800.0 | 7.25 | 4.90 | 5.30 | 0.000000 | 0.000000 | 807.0 | 0 | 0.214394 | False |

| 27 | SPXW250820P05825000 | 2025-07-23 19:59:30+00:00 | 5825.0 | 8.40 | 5.20 | 5.60 | 0.000000 | 0.000000 | 20.0 | 0 | 0.208702 | False |

| 28 | SPXW250820P05850000 | 2025-07-25 19:44:58+00:00 | 5850.0 | 7.30 | 5.60 | 6.00 | 0.000000 | 0.000000 | 12.0 | 0 | 0.203469 | False |

| 29 | SPXW250820P05875000 | 2025-07-25 20:03:13+00:00 | 5875.0 | 7.70 | 6.10 | 6.40 | 0.000000 | 0.000000 | 41.0 | 0 | 0.197976 | False |

| 30 | SPXW250820P05900000 | 2025-07-25 19:03:54+00:00 | 5900.0 | 8.20 | 6.60 | 6.90 | 0.000000 | 0.000000 | 4.0 | 0 | 0.192833 | False |

| 31 | SPXW250820P05925000 | 2025-07-25 15:01:11+00:00 | 5925.0 | 9.40 | 7.10 | 7.50 | 0.000000 | 0.000000 | 6.0 | 0 | 0.187905 | False |

| 32 | SPXW250820P05950000 | 2025-07-25 19:44:10+00:00 | 5950.0 | 9.90 | 7.80 | 8.10 | 0.000000 | 0.000000 | 12.0 | 0 | 0.182625 | False |

| 33 | SPXW250820P05975000 | 2025-07-25 15:29:05+00:00 | 5975.0 | 11.16 | 8.50 | 8.90 | 0.000000 | 0.000000 | 1.0 | 0 | 0.177949 | False |

| 34 | SPXW250820P06000000 | 2025-07-25 19:44:29+00:00 | 6000.0 | 12.10 | 9.40 | 9.70 | 0.000000 | 0.000000 | 6.0 | 0 | 0.172814 | False |

| 35 | SPXW250820P06025000 | 2025-07-23 20:06:00+00:00 | 6025.0 | 17.34 | 10.40 | 10.70 | 0.000000 | 0.000000 | 2.0 | 0 | 0.168069 | False |

| 36 | SPXW250820P06050000 | 2025-07-28 00:15:00+00:00 | 6050.0 | 12.18 | 11.40 | 11.80 | -2.320000 | -15.999998 | 5.0 | 0 | 0.163186 | False |

| 37 | SPXW250820P06075000 | 2025-07-28 00:15:00+00:00 | 6075.0 | 13.58 | 12.60 | 13.10 | -2.719999 | -16.687113 | 5.0 | 0 | 0.158463 | False |

| 38 | SPXW250820P06100000 | 2025-07-25 18:15:22+00:00 | 6100.0 | 18.15 | 14.10 | 14.70 | 0.000000 | 0.000000 | 11.0 | 0 | 0.154084 | False |

| 39 | SPXW250820P06110000 | 2025-07-25 19:35:59+00:00 | 6110.0 | 18.72 | 14.70 | 15.20 | 0.000000 | 0.000000 | 4.0 | 0 | 0.151711 | False |

| 40 | SPXW250820P06125000 | 2025-07-23 20:06:00+00:00 | 6125.0 | 26.39 | 15.70 | 16.20 | 0.000000 | 0.000000 | 95.0 | 0 | 0.148728 | False |

| 42 | SPXW250820P06140000 | 2025-07-23 14:37:25+00:00 | 6140.0 | 36.73 | 16.80 | 17.30 | 0.000000 | 0.000000 | 5.0 | 0 | 0.145768 | False |

| 43 | SPXW250820P06150000 | 2025-07-25 19:51:42+00:00 | 6150.0 | 22.40 | 17.60 | 18.10 | 0.000000 | 0.000000 | 33.0 | 0 | 0.143830 | False |

| 45 | SPXW250820P06170000 | 2025-07-23 15:57:02+00:00 | 6170.0 | 35.67 | 19.20 | 19.80 | 0.000000 | 0.000000 | 2.0 | 0 | 0.139833 | False |

| 46 | SPXW250820P06175000 | 2025-07-28 00:15:00+00:00 | 6175.0 | 20.83 | 19.70 | 20.20 | -9.469999 | -31.254124 | 2.0 | 0 | 0.138692 | False |

| 48 | SPXW250820P06190000 | 2025-07-25 14:54:57+00:00 | 6190.0 | 28.37 | 21.10 | 21.60 | 0.000000 | 0.000000 | 5.0 | 0 | 0.135568 | False |

| 49 | SPXW250820P06200000 | 2025-07-28 00:15:00+00:00 | 6200.0 | 23.43 | 22.10 | 22.60 | -4.570000 | -16.321428 | 2.0 | 0 | 0.133466 | False |

| 52 | SPXW250820P06225000 | 2025-07-25 19:52:19+00:00 | 6225.0 | 31.30 | 24.80 | 25.50 | 0.000000 | 0.000000 | 3.0 | 0 | 0.128450 | False |

| 53 | SPXW250820P06230000 | 2025-07-25 19:59:09+00:00 | 6230.0 | 32.20 | 25.40 | 26.10 | 0.000000 | 0.000000 | 3.0 | 0 | 0.127370 | False |

| 55 | SPXW250820P06250000 | 2025-07-25 19:59:02+00:00 | 6250.0 | 35.20 | 27.90 | 28.50 | 0.000000 | 0.000000 | 12.0 | 0 | 0.122655 | False |

| 56 | SPXW250820P06260000 | 2025-07-25 19:59:00+00:00 | 6260.0 | 36.80 | 29.40 | 29.90 | 0.000000 | 0.000000 | 3.0 | 0 | 0.120439 | False |

| 58 | SPXW250820P06275000 | 2025-07-25 18:25:43+00:00 | 6275.0 | 39.51 | 31.60 | 32.10 | 0.000000 | 0.000000 | 14.0 | 0 | 0.116964 | False |

| 59 | SPXW250820P06280000 | 2025-07-25 19:59:05+00:00 | 6280.0 | 40.70 | 32.30 | 32.90 | 0.000000 | 0.000000 | 8.0 | 0 | 0.115834 | False |

| 60 | SPXW250820P06290000 | 2025-07-25 19:59:16+00:00 | 6290.0 | 42.80 | 34.00 | 34.60 | 0.000000 | 0.000000 | 3.0 | 0 | 0.113599 | False |

| 61 | SPXW250820P06300000 | 2025-07-25 20:11:02+00:00 | 6300.0 | 44.80 | 35.70 | 36.40 | 0.000000 | 0.000000 | 15.0 | 0 | 0.111326 | False |

| 62 | SPXW250820P06310000 | 2025-07-25 19:59:42+00:00 | 6310.0 | 47.20 | 37.60 | 38.30 | 0.000000 | 0.000000 | 4.0 | 0 | 0.108999 | False |

| 63 | SPXW250820P06320000 | 2025-07-25 19:35:39+00:00 | 6320.0 | 48.85 | 39.60 | 40.20 | 0.000000 | 0.000000 | 3.0 | 0 | 0.106435 | False |

| 64 | SPXW250820P06325000 | 2025-07-25 13:47:22+00:00 | 6325.0 | 57.90 | 40.60 | 41.30 | 0.000000 | 0.000000 | 4.0 | 0 | 0.105314 | False |

| 65 | SPXW250820P06330000 | 2025-07-25 19:35:56+00:00 | 6330.0 | 51.45 | 41.70 | 42.30 | 0.000000 | 0.000000 | 7.0 | 0 | 0.103959 | False |

| 66 | SPXW250820P06340000 | 2025-07-25 13:37:46+00:00 | 6340.0 | 61.92 | 43.90 | 44.60 | 0.000000 | 0.000000 | 4.0 | 0 | 0.101545 | False |

| 67 | SPXW250820P06350000 | 2025-07-25 19:58:36+00:00 | 6350.0 | 57.50 | 46.30 | 47.00 | 0.000000 | 0.000000 | 11.0 | 0 | 0.099000 | False |

| 68 | SPXW250820P06360000 | 2025-07-25 14:30:50+00:00 | 6360.0 | 66.90 | 48.70 | 49.50 | 0.000000 | 0.000000 | 1.0 | 0 | 0.096311 | False |

| 70 | SPXW250820P06375000 | 2025-07-25 19:52:10+00:00 | 6375.0 | 66.77 | 52.90 | 53.70 | 0.000000 | 0.000000 | 1.0 | 0 | 0.092359 | False |

| 71 | SPXW250820P06380000 | 2025-07-25 19:52:19+00:00 | 6380.0 | 67.10 | 54.40 | 55.20 | 0.000000 | 0.000000 | 2.0 | 0 | 0.091013 | False |

| 72 | SPXW250820P06390000 | 2025-07-25 19:52:19+00:00 | 6390.0 | 70.80 | 57.40 | 58.20 | 0.000000 | 0.000000 | 3.0 | 0 | 0.088033 | True |

| 73 | SPXW250820P06400000 | 2025-07-25 19:52:19+00:00 | 6400.0 | 74.70 | 60.70 | 61.50 | 0.000000 | 0.000000 | 2.0 | 0 | 0.085088 | True |

| 75 | SPXW250820P06420000 | 2025-07-25 19:57:32+00:00 | 6420.0 | 83.10 | 68.00 | 68.90 | 0.000000 | 0.000000 | 1.0 | 0 | 0.078977 | True |

| 76 | SPXW250820P06425000 | 2025-07-25 19:58:28+00:00 | 6425.0 | 84.90 | 69.90 | 70.80 | 0.000000 | 0.000000 | 1.0 | 0 | 0.077177 | True |

| 79 | SPXW250820P06450000 | 2025-07-25 17:59:21+00:00 | 6450.0 | 98.02 | 80.70 | 81.60 | 0.000000 | 0.000000 | 63.0 | 0 | 0.067556 | True |

| 81 | SPXW250820P06550000 | 2025-07-25 19:36:12+00:00 | 6550.0 | 162.00 | 139.50 | 142.20 | 0.000000 | 0.000000 | 1.0 | 0 | 0.000010 | True |

# save data as csv

#spx_calls.to_csv('spxcall_07252022.csv', index=False)

#spx_puts.to_csv('spxput_07252022.csv', index=False)You may start from here

# read saved spx option data

spx_calls = pd.read_csv('spxcall_07252022.csv')

spx_puts = pd.read_csv('spxput_07252022.csv')Create python class OptionAnalytics

Wrap everything up in a python class.

class OptionAnalytics:

def __init__(self, option_chain, expiry, today):

self.expiry = expiry

self.today = today

if not type(today) == datetime.datetime:

self.today = dt.strptime(today, '%Y-%m-%d')

self.calls, self.puts = option_chain

self.ks_c = self.calls['strike']

self.cs = (self.calls['bid'] + self.calls['ask'])/2

self.ks_p = self.puts['strike']

self.ps = (self.puts['bid'] + self.puts['ask'])/2

# strikes that are traded for both calls and puts

self.ks = np.array([])

for k in self.ks_c:

if k in np.array(self.ks_p):

self.ks = np.concatenate([self.ks, [k]])

self.mids_call = np.array([])

for k in self.ks:

self.calls[self.calls['strike'] == k]['bid']

bid = self.calls[self.calls['strike'] == k]['bid']

ask = self.calls[self.calls['strike'] == k]['ask']

self.mids_call = np.concatenate([self.mids_call, np.array((bid + ask)/2)])

self.mids_put = np.array([])

for k in self.ks:

bid = self.puts[self.puts['strike'] == k]['bid']

ask = self.puts[self.puts['strike'] == k]['ask']

self.mids_put = np.concatenate([self.mids_put, np.array((bid + ask)/2)])

tmp = self.imp_vols()

self.ivs, self.s_adj = tmp['imp_vols'], tmp['s_adj']

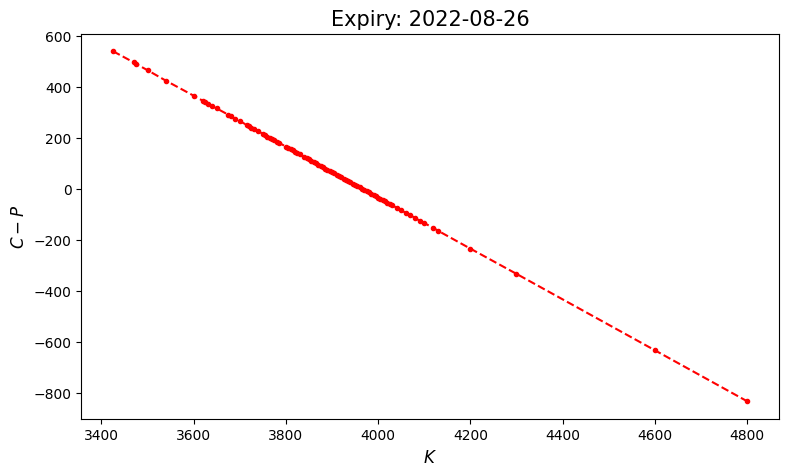

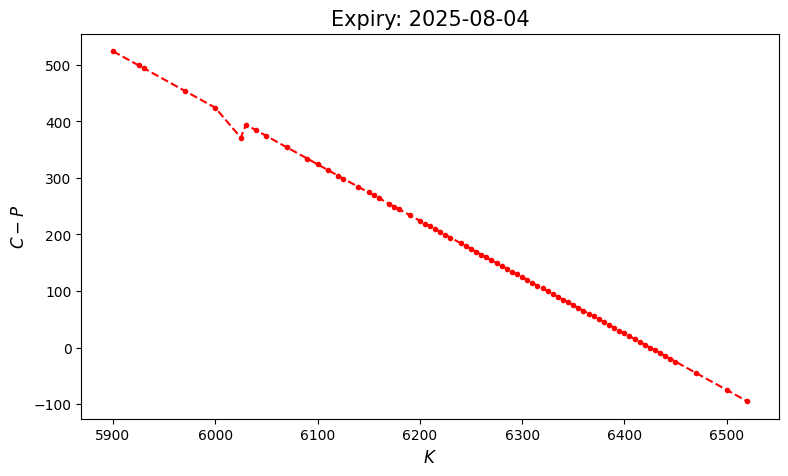

# put-call parity plot

def plot_parity(self):

plt.figure(figsize=(9, 5))

plt.plot(self.ks, self.mids_call - self.mids_put, 'r.--')

plt.ylabel(r'$C - P$', fontsize=12)

plt.xlabel(r'$K$', fontsize=12)

plt.title(f'Expiry: {self.expiry}', fontsize=15);

return None

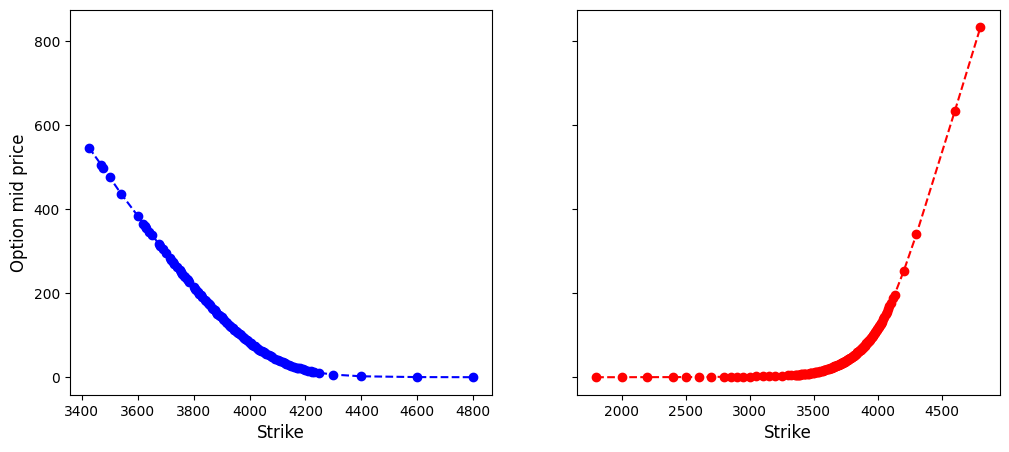

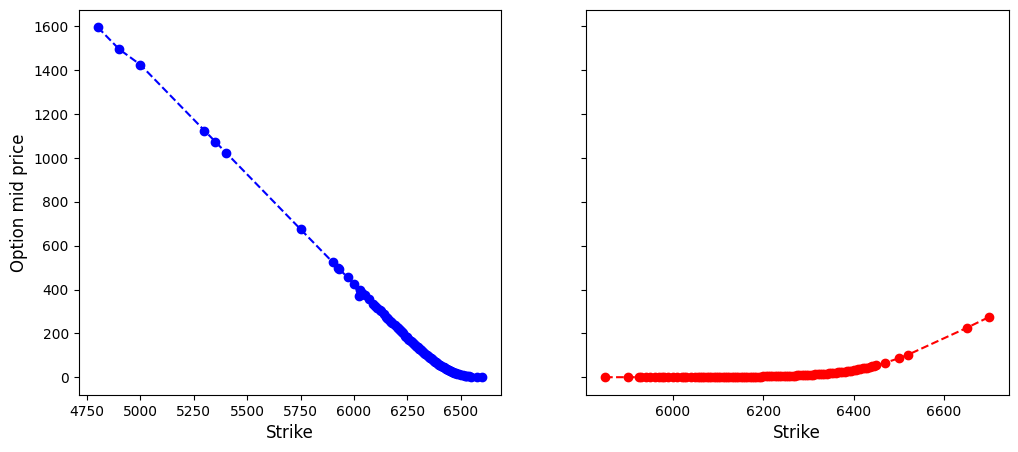

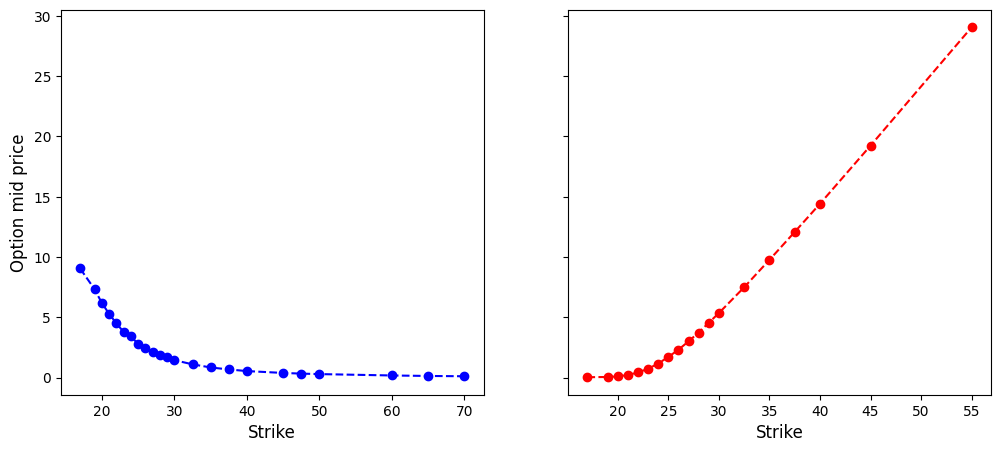

def plot_arb(self):

# monotonicity and convexity for option premia vs strikes

fig, axes = plt.subplots(1, 2, figsize=(12, 5), sharey=True)

axes[0].plot(self.ks_c, self.cs, 'bo--')

axes[0].set_ylabel('Option mid price', fontsize=12)

axes[0].set_xlabel('Strike', fontsize=12)

axes[1].plot(self.ks_p, self.ps, 'ro--')

axes[1].set_xlabel('Strike', fontsize=12);

return None

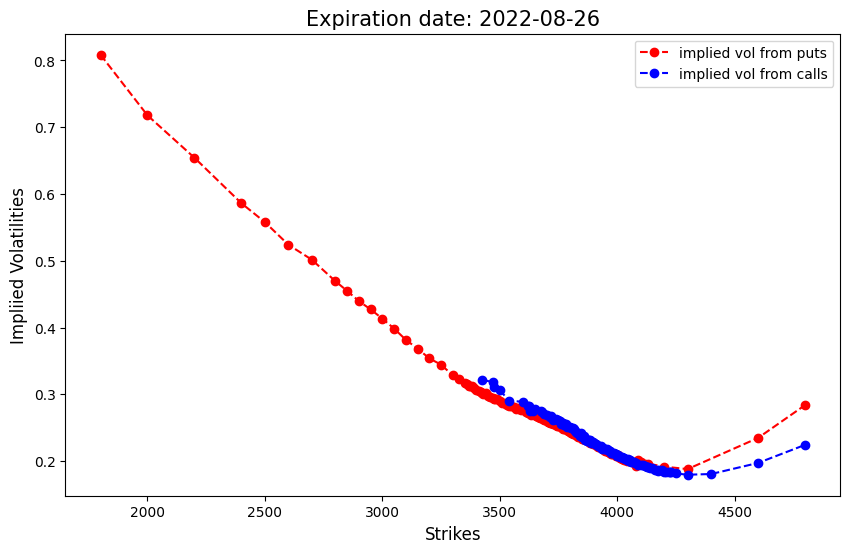

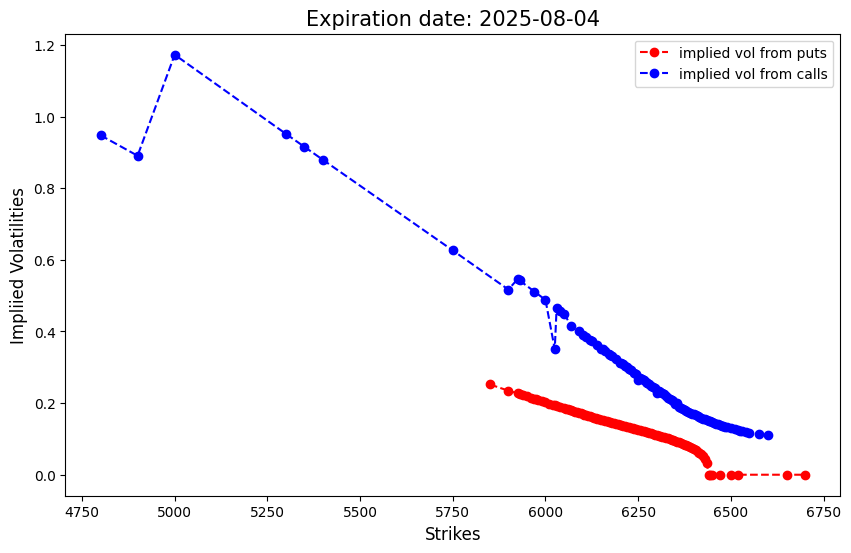

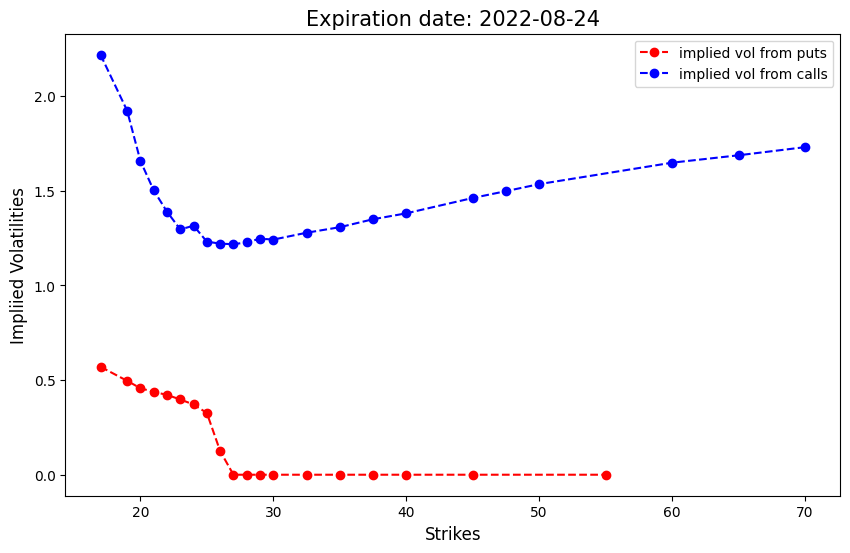

# plot implied vol

def plot_imp_vols1(self):

ivs_c = self.calls['impliedVolatility']

ivs_p = self.puts['impliedVolatility']

# plot

plt.figure(figsize=(10, 6))

plt.plot(self.ks_p, ivs_p, 'ro--', label='implied vol from puts')

plt.plot(self.ks_c, ivs_c, 'bo--', label='implied vol from calls')

plt.title(f'Expiration date: {self.expiry}', fontsize=15)

plt.xlabel('Strikes', fontsize=12)

plt.ylabel('Impliied Volatilities', fontsize=12)

plt.legend();

return None

# Black-Scholes formula for call

def bs_call(self, s, K, t, sigma, r=0):

d1 = (log(s/K) + r*t)/(sigma*sqrt(t)) + sigma*sqrt(t)/2

d2 = d1 - sigma*sqrt(t)

return s*norm.cdf(d1) - K*exp(-r*t)*norm.cdf(d2)

# function calculating implied vol by the bisection method

def bs_impvol_call(self, s0, K, T, C, r=0):

K = np.array([K])

n = len(K)

sigmaL, sigmaH = 1e-10*np.ones(n), 10*np.ones(n)

CL, CH = self.bs_call(s0, K, T, sigmaL, r), self.bs_call(s0, K, T, sigmaH, r)

while np.mean(sigmaH - sigmaL) > 1e-10:

sigma = (sigmaL + sigmaH)/2

CM = self.bs_call(s0, K, T, sigma, r)

CL = CL + (CM < C)*(CM - CL)

sigmaL = sigmaL + (CM < C)*(sigma - sigmaL)

CH = CH + (CM >= C)*(CM - CH)

sigmaH = sigmaH + (CM >= C)*(sigma - sigmaH)

return sigma[0]

# calculate implied vols

def imp_vols(self):

# regress call - put over strike K

# apply put-call parity

df = {'CP': self.mids_call - self.mids_put, 'Strike': self.ks}

result = sm.ols(formula='CP ~ Strike', data=df).fit()

s_adj, pv = result.params[0], -result.params[1]

ks_pv = self.ks*pv

days_to_expiry = (dt.strptime(self.expiry, '%Y-%m-%d') - self.today).days

imp_vols = self.bs_impvol_call(s_adj, ks_pv, days_to_expiry/365, self.mids_call, r=0)

return {'imp_vols': imp_vols, 'pv': pv, 's_adj': s_adj}

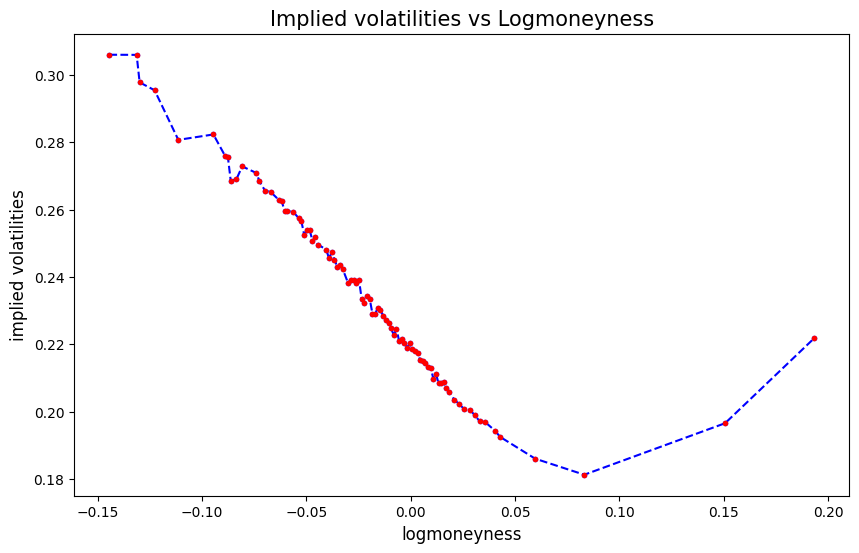

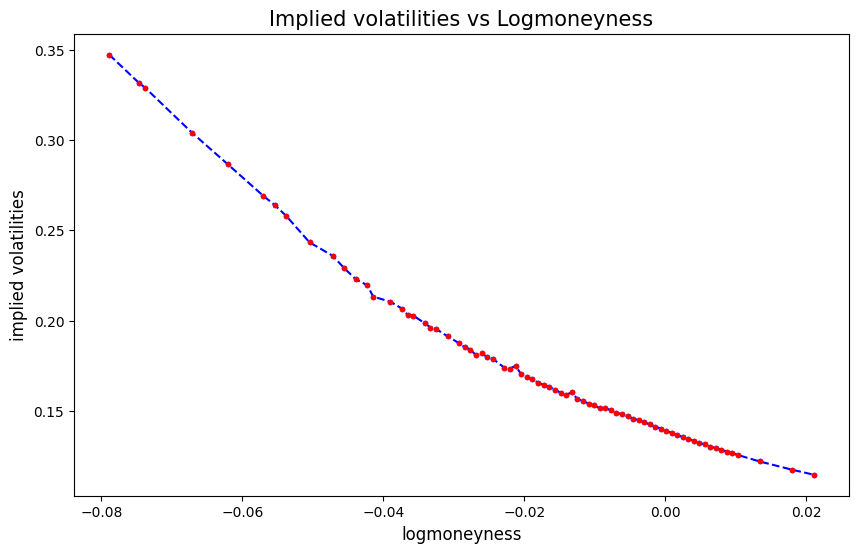

# plot implied vol

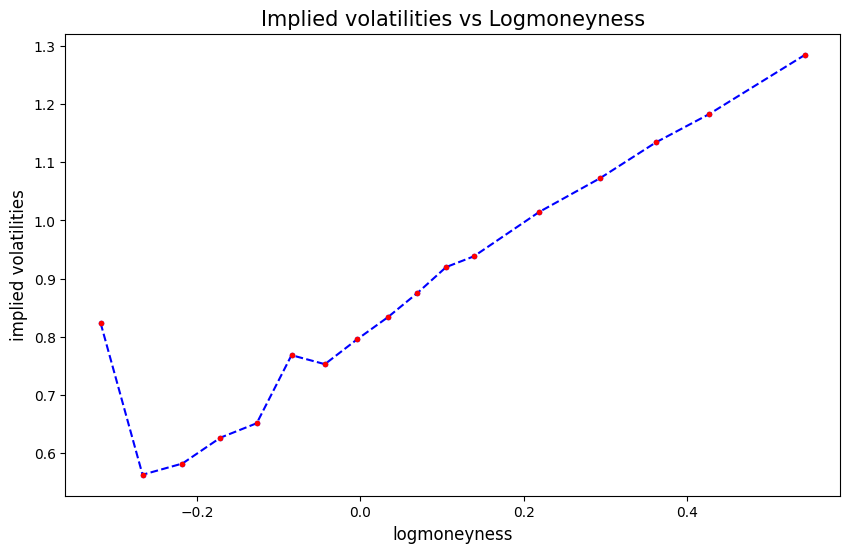

def plot_imp_vols2(self):

plt.figure(figsize=(10, 6))

y = self.ivs[self.ivs>0.001]

x = self.ks[self.ivs>0.001]

plt.plot(log(x/self.s_adj), y, 'b.--')

plt.plot(log(x/self.s_adj), y, 'r.')

plt.xlabel('logmoneyness', fontsize=12)

plt.ylabel('implied volatilities', fontsize=12)

plt.title('Implied volatilities vs Logmoneyness', fontsize=15);

return None

def __call__(self):

passexpiry = '2022-08-26'

today = '2022-07-25'

# today = dt.now()

spx_opt = OptionAnalytics([spx_calls, spx_puts], expiry, today)

#spx_opt = OptionAnalytics([spx_calls, spx_puts], spx_expiries[idx])C:\Windows\Temp\ipykernel_3812\903028481.py:94: FutureWarning: Series.__getitem__ treating keys as positions is deprecated. In a future version, integer keys will always be treated as labels (consistent with DataFrame behavior). To access a value by position, use `ser.iloc[pos]`

s_adj, pv = result.params[0], -result.params[1]spx_opt.plot_arb()

spx_opt.plot_parity()

spx_opt.s_adj3956.9116921934447spx_opt.imp_vols()C:\Windows\Temp\ipykernel_3812\903028481.py:94: FutureWarning: Series.__getitem__ treating keys as positions is deprecated. In a future version, integer keys will always be treated as labels (consistent with DataFrame behavior). To access a value by position, use `ser.iloc[pos]`

s_adj, pv = result.params[0], -result.params[1]{'imp_vols': array([0.30600045, 0.30595555, 0.2977905 , 0.29545201, 0.28072122,

0.28232929, 0.2760224 , 0.27571335, 0.26859412, 0.26908309,

0.27284159, 0.2708769 , 0.26853801, 0.26566743, 0.26527454,

0.26282943, 0.26242285, 0.2594965 , 0.25959885, 0.25941643,

0.25750019, 0.25653246, 0.25254566, 0.25387708, 0.25385611,

0.2507587 , 0.25183417, 0.24960497, 0.24816526, 0.24549749,

0.2473746 , 0.24511455, 0.24306506, 0.24344569, 0.24239335,

0.2381772 , 0.23923107, 0.23911993, 0.23822523, 0.23924822,

0.23345209, 0.23237829, 0.2344444 , 0.23344536, 0.22909791,

0.22899399, 0.23093383, 0.23010241, 0.22853441, 0.22734051,

0.22629503, 0.22473931, 0.22267772, 0.22467133, 0.22094489,

0.22158022, 0.22029972, 0.21894173, 0.22040126, 0.21866736,

0.21803138, 0.21752707, 0.21522827, 0.21498524, 0.21433691,

0.21338911, 0.21299896, 0.20983357, 0.21131474, 0.20839273,

0.20862321, 0.20877018, 0.20719259, 0.20584517, 0.20362794,

0.20224901, 0.20071144, 0.20063567, 0.19902292, 0.19711411,

0.19699863, 0.19436676, 0.1925327 , 0.18606077, 0.18129871,

0.1965902 , 0.22174679]),

'pv': 0.9978522732469026,

's_adj': 3956.9116921934447}spx_opt.plot_imp_vols2(), spx_opt.plot_imp_vols1();

A shorter time to expiry option on SPX

Tips: You may skip this part if you encounter an error.

# choose an expiry

idx = 5

today = dt.strftime(dt.now(), '%Y-%m-%d')

day_count = (dt.strptime(spx_expiries[idx], '%Y-%m-%d') - dt.now()).days

print(f'option expiry = {spx_expiries[idx]}, today = {today}')

print(f'There are {day_count} days to expiry')

option_chain = spx.option_chain(spx_expiries[idx])

spx_calls1 = option_chain.calls

spx_puts1 = option_chain.putsoption expiry = 2025-08-04, today = 2025-07-28

There are 6 days to expiry# clean data

spx_calls1 = spx_calls1.dropna()

spx_calls1 = spx_calls1[(spx_calls1['bid'] > 0) & (spx_calls1['ask'] > 0)]

spx_puts1 = spx_puts1.dropna()

spx_puts1 = spx_puts1[(spx_puts1['bid'] > 0) & (spx_puts1['ask'] > 0)]today = dt.now()

spx_opt1 = OptionAnalytics([spx_calls1, spx_puts1], spx_expiries[idx], today)C:\Windows\Temp\ipykernel_3812\903028481.py:94: FutureWarning: Series.__getitem__ treating keys as positions is deprecated. In a future version, integer keys will always be treated as labels (consistent with DataFrame behavior). To access a value by position, use `ser.iloc[pos]`

s_adj, pv = result.params[0], -result.params[1]spx_opt1.plot_arb()

spx_opt1.plot_parity()

spx_opt.imp_vols()['pv']C:\Windows\Temp\ipykernel_3812\903028481.py:94: FutureWarning: Series.__getitem__ treating keys as positions is deprecated. In a future version, integer keys will always be treated as labels (consistent with DataFrame behavior). To access a value by position, use `ser.iloc[pos]`

s_adj, pv = result.params[0], -result.params[1]0.9978522732469026spx_opt1.s_adj, spx_opt1.imp_vols()['pv']C:\Windows\Temp\ipykernel_3812\903028481.py:94: FutureWarning: Series.__getitem__ treating keys as positions is deprecated. In a future version, integer keys will always be treated as labels (consistent with DataFrame behavior). To access a value by position, use `ser.iloc[pos]`

s_adj, pv = result.params[0], -result.params[1](6384.272448907927, 0.9936040369548137)spx_opt1.plot_imp_vols2(), spx_opt1.plot_imp_vols1();

You may start from here.

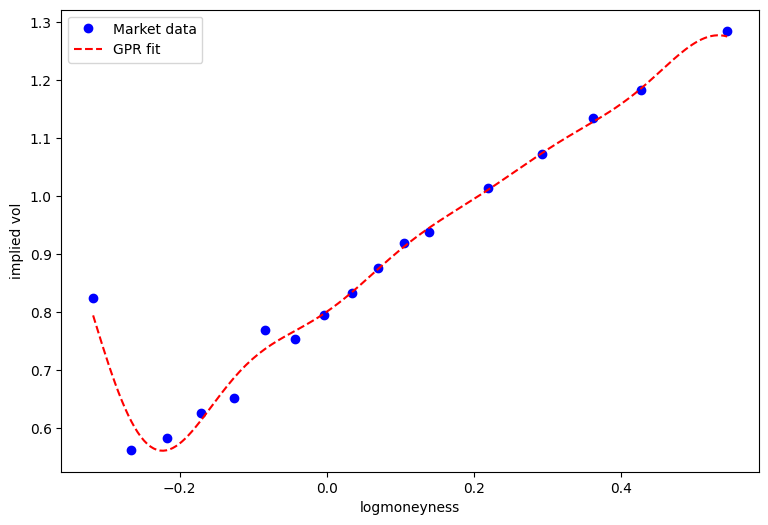

GPR fit for SPX implied volatility curve

# The posterior mean function from GPR

# inputs:

# m: prior mean function

# k: prior kernel

# y: observations

# x: indices

#

# output: the posterior mean function

def pos_mean(m, k, y, x, sigma=0.001):

n = len(x)

# calculate the covariance matrices

tmp, _ = np.meshgrid(x, x)

Sigma_YY = k(tmp, _)

Sigma_YY = Sigma_YY + sigma**2*np.identity(n)

# determine Sigma_YY_inv(Y - EY) by solving the linear system Sigma_YY x = Y - EY

Sigma_YY_inv_Y_EY = np.linalg.solve(Sigma_YY, y - m(x))

# return the posterior mean function

return lambda xx: m(xx) + sum(k(xx, x)*Sigma_YY_inv_Y_EY)

# The posterior kernel from GPR

# inputs:

# k: prior kernel

# x: indices

#

# output: the posterior kernel

def pos_kernel(k, x, sigma=0.1):

n = len(x)

# calculate the covariance matrices

tmp, _ = np.meshgrid(x, x)

Sigma_YY = k(tmp, _)

Sigma_YY = Sigma_YY + sigma**2*np.identity(n)

# return the posterior kernel

def _(xx, xp):

# determine Sigma_YY_inv Sigma_Yxp by solving the linear system Sigma_YY x = Sigma_Yxp

Sigma_YY_inv_Yxp = np.linalg.solve(Sigma_YY, k(xp, x))

Sigma_xY = k(xx, x)

return k(xx, xp) - sum(Sigma_xY*Sigma_YY_inv_Yxp)

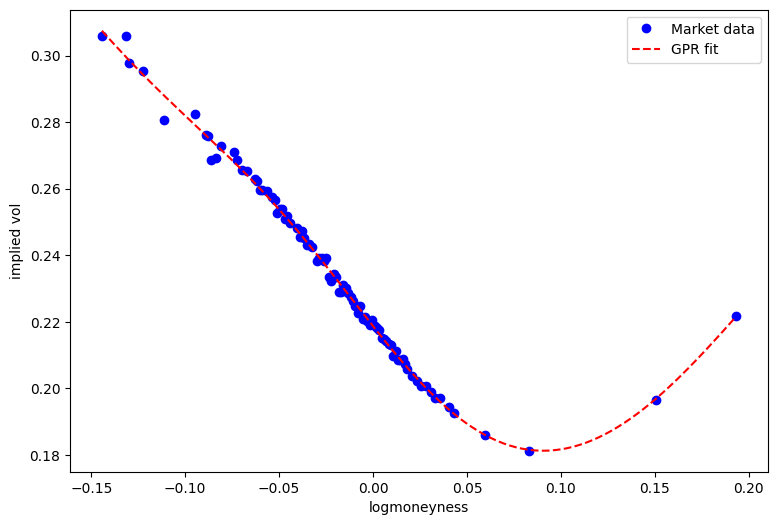

return _ imp_vols = spx_opt.ivs

logmnyns = np.log(spx_opt.ks/spx_opt.s_adj)

# set hyperparameters by guessing

A, l, sigma = 0.1, 0.1, 0.01

# prior mean function

# set prior mean as sample mean of implied vols

iv_mean = imp_vols.mean()

mpr = lambda x: iv_mean

# prior kernel

k = lambda x, y: A*np.exp(-np.abs(x-y)**2/2/l**2)

# indices and observations

x_is = logmnyns

n = len(x_is)

y_is = imp_vols

# posterior mean function for implied vol

mpo_iv = pos_mean(mpr, k, y_is, x_is, sigma=sigma)

mpo_iv = np.vectorize(mpo_iv)

mpo_iv(x_is)

# fitted values

iv_hat = mpo_iv(x_is)

pd.DataFrame(y_is, iv_hat)| 0 | |

|---|---|

| 0.307461 | 0.306000 |

| 0.299448 | 0.305956 |

| 0.298590 | 0.297790 |

| 0.294401 | 0.295452 |

| 0.288030 | 0.280721 |

| ... | ... |

| 0.192479 | 0.192533 |

| 0.185995 | 0.186061 |

| 0.181538 | 0.181299 |

| 0.196908 | 0.196590 |

| 0.221521 | 0.221747 |

87 rows × 1 columns

# plot

plt.figure(figsize=(9, 6))

plt.plot(x_is, y_is, 'bo', label='Market data')

plt.xlabel('logmoneyness')

plt.ylabel('implied vol')

x = np.linspace(x_is.min(), x_is.max(), 200)

plt.plot(x, mpo_iv(x), 'r--', label='GPR fit')

plt.legend();

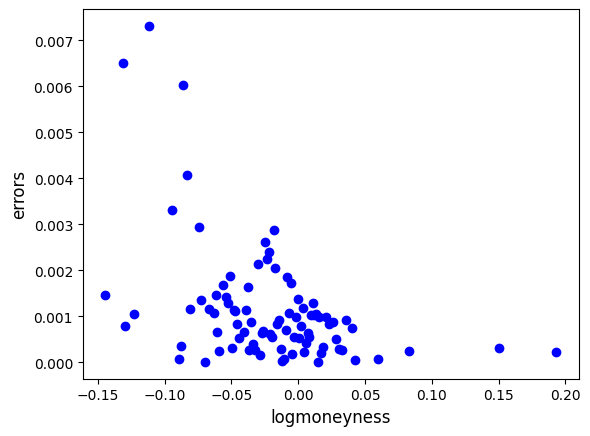

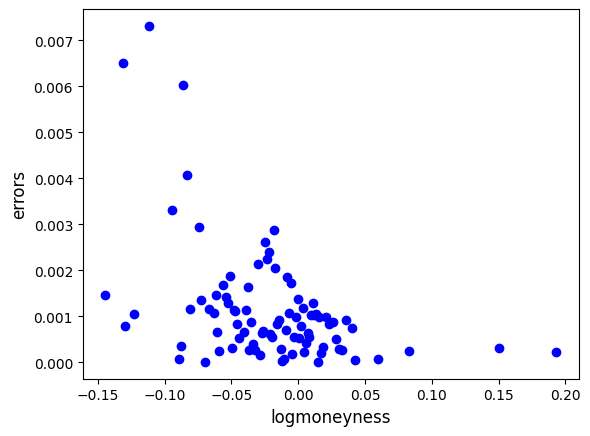

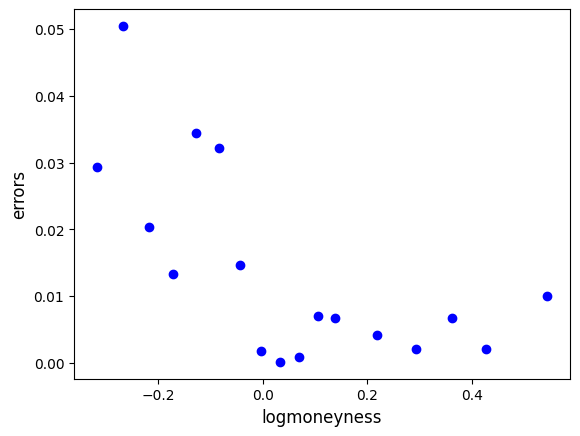

# analysis on absolute errors

abs_errs = np.abs(iv_hat - y_is)

plt.plot(x_is, abs_errs, 'bo')

plt.xlabel('logmoneyness', fontsize=12)

plt.ylabel('errors', fontsize=12)

pd.DataFrame(abs_errs).describe().transpose()| count | mean | std | min | 25% | 50% | 75% | max | |

|---|---|---|---|---|---|---|---|---|

| 0 | 87.0 | 0.001156 | 0.001303 | 0.000011 | 0.000347 | 0.000829 | 0.001325 | 0.007309 |

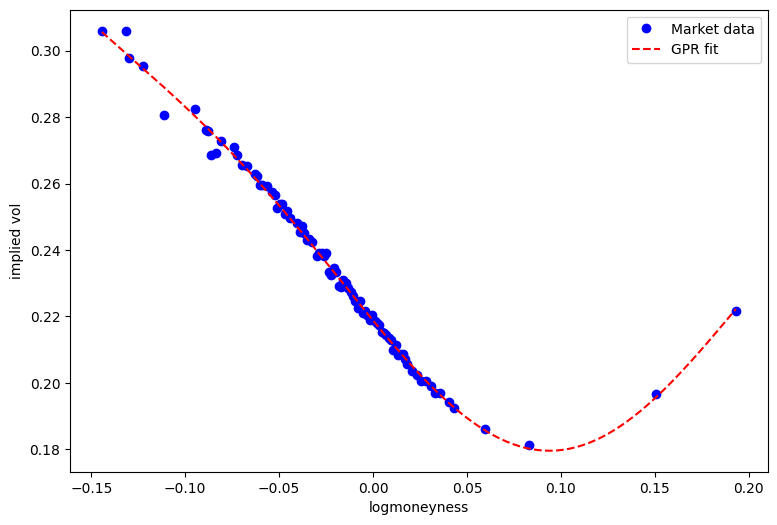

Fine tune hyperparameters by MLE

# estimate the hyperparameters by MLE

# objective function

def obj(x, y):

def _(params):

A, l, sigma = params

k = lambda u, v: A*np.exp(-np.abs(u-v)**2/2/l**2)

n = len(x)

# calculate the covariance matrices

tmp, _ = np.meshgrid(x, x)

Sigma_YY = k(tmp, _)

Sigma_YY = Sigma_YY + sigma**2*np.identity(n)

Sigma_YY_inv_y = np.linalg.solve(Sigma_YY, y)

return np.log(np.linalg.det(Sigma_YY)) + sum(y*Sigma_YY_inv_y) #this is in fact negative log likelihood

return _from scipy.optimize import minimize%%time

# minimize objective function

print(obj(x_is, y_is)([0.1, 0.1, 0.1]))

pars = [0.1, 0.1, 0.1]

res = minimize(obj(x_is, y_is), pars, method='nelder-mead',

options={'xatol': 1e-8, 'disp': True})

hyparams = res.x

hyparams-381.2423169273305C:\Windows\Temp\ipykernel_3812\1457444304.py:14: RuntimeWarning: divide by zero encountered in log

return np.log(np.linalg.det(Sigma_YY)) + sum(y*Sigma_YY_inv_y) #this is in fact negative log likelihood

d:\HuaweiMoveData\Users\平面向皮卡丘\Desktop\24-25-3\量化金融专题\slides\.venv\Lib\site-packages\scipy\optimize\_optimize.py:869: RuntimeWarning: invalid value encountered in subtract

np.max(np.abs(fsim[0] - fsim[1:])) <= fatol):CPU times: total: 18.2 s

Wall time: 9.85 s<timed exec>:4: RuntimeWarning: Maximum number of function evaluations has been exceeded.array([ 0.13481481, 0.16574074, -0.00740741])# hyperparameters estimated from MLE

A, l, sigma = hyparams

# prior mean function

# set prior mean as sample mean of implied vols

iv_mean = imp_vols.mean()

mpr = lambda x: iv_mean

# prior kernel

k = lambda x, y: A*np.exp(-np.abs(x-y)**2/2/l**2)

# indices and observations

x_is = logmnyns

n = len(x_is)

y_is = imp_vols

# posterior mean function for implied vol

mpo_iv = pos_mean(mpr, k, y_is, x_is, sigma=sigma)

mpo_iv = np.vectorize(mpo_iv)

#mpo_iv(x_is)# plot

plt.figure(figsize=(9, 6))

plt.plot(x_is, y_is, 'bo', label='Market data')

plt.xlabel('logmoneyness')

plt.ylabel('implied vol')

x = np.linspace(x_is.min(), x_is.max(), 200)

plt.plot(x, mpo_iv(x), 'r--', label='GPR fit')

plt.legend();

# analysis on absolute errors

abs_errs = np.abs(iv_hat - y_is)

plt.plot(x_is, abs_errs, 'bo')

plt.xlabel('logmoneyness', fontsize=12)

plt.ylabel('errors', fontsize=12)

pd.DataFrame(abs_errs).describe().transpose()| count | mean | std | min | 25% | 50% | 75% | max | |

|---|---|---|---|---|---|---|---|---|

| 0 | 87.0 | 0.001156 | 0.001303 | 0.000011 | 0.000347 | 0.000829 | 0.001325 | 0.007309 |

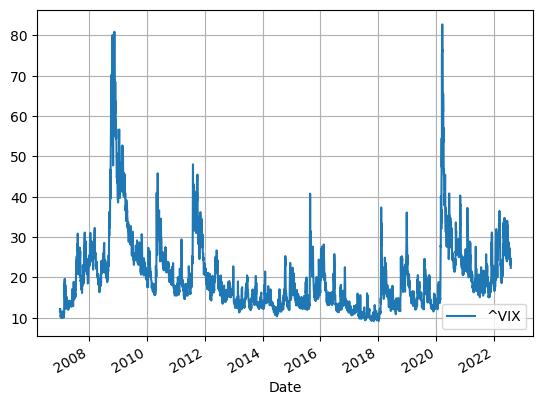

What is VIX?

Quote from this page in Investopedia:

Created by the Chicago Board Options Exchange (CBOE), the Volatility Index, or VIX, is a real-time market index that represents the market’s expectation of 30-day forward-looking volatility. Derived from the price inputs of the S&P 500 index options, it provides a measure of market risk and investors’ sentiments. It is also known by other names like “Fear Gauge” or “Fear Index.” Investors, research analysts and portfolio managers look to VIX values as a way to measure market risk, fear and stress before they take investment decisions.

Introduced in 1993, the Volatility Index (VIX) was initially a weighted measure of the implied volatility (IV) of eight S&P 100 at-the-money put and call options. Ten years later, in 2004, it expanded to use options based on a broader index, the S&P 500. This expansion allows for a more accurate view of investors’ expectations on future market volatility. VIX values higher than 30 are usually associated with a significant amount of volatility as a result of investor fear or uncertainty. Values below 15 ordinarily correspond to less stressful, or even complacent, times in the markets.

Originally, the VIX computation was designed to mimic the implied volatility of an at-the-money 1 month option on the OEX index. It did this by averaging volatilities from 8 options (puts and calls from the closest to ATM strikes in the nearest and next to nearest months).

The CBOE changed the VIX computation: “CBOE is changing VIX to provide a more precise and robust measure of expected market volatility and to create a viable underlying index for tradable volatility products.”

CBOE listed futures on the VIX in 2004.

Volatility indices published by CBOE

In addition to VIX, other volatility indices published by CBOE include

- VIX9D

- VIX3M

- VIX6M

- VOX

- VXD: Dow Jones index volatility

- RVX

- VXN

- VVIX: VIX of VIX.

| 指数 | 标的资产 | 期限 | 用途 |

|---|---|---|---|

| VIX9D | 标普 500 | 9 天 | 短期市场波动对冲 |

| VIX3M | 标普 500 | 3 个月 | 中长期波动管理 |

| VIX6M | 标普 500 | 6 个月 | 长期波动对冲 |

| VOX | 纳斯达克 100 | 30 天 | 科技股波动监测 |

| VXD | 道琼斯工业平均指数 | 30 天 | 蓝筹股波动监测 |

| RVX | 房地产投资信托 (REITs) | 30 天 | 房地产市场波动监测 |

| VXN | 纳斯达克综合指数 | 30 天 | 科技股及小型股波动监测 |

| VVIX | VIX 指数本身 | 30 天 | 波动率的波动性 (市场恐慌指标) |

Note

More volatility indices published by CBOE can be found in this link.

VIX Chart from Investopedia

“Formula of financial engineering”

Engineering: “Build something new out of something that is not.”

Notice that all payoffs we saw before can be expressed as a combination of payoffs from calls and puts, even the underlying itself since it can be regarded as a call struck at zero. A natural question to ask is, to what extent, can a given payoff function be represented as a combination of calls and puts?

The answer is surprisingly “all the payoffs”! The following formula shows how.

Let \(\varphi\) be a payoff function, we have

\[ \varphi(s) = \varphi(f) + \varphi'(f)(s - f) + \int_f^\infty (s - k)^+ \varphi''(k) \mathrm{d}k + \int_0^f (k - s)^+ \varphi''(k)\mathrm{d}k. \]

Let \(\delta\) denote the Dirac delta function and \(\theta\) the Heaviside function. Note that heuristically \(\theta' = \delta\), i.e., the Dirac delta can be regarded as the derivative of the Heaviside function.

The payoff \(\varphi(s)\) at time \(T\) can be written as

\[\begin{aligned} \varphi(s) &= \int_0^\infty \varphi(k) \delta(s - k)\,\mathrm{d}k \\ &= \int_0^f \varphi(k) \delta(s - k)\,\mathrm{d}k + \int_f^\infty \varphi(k) \delta(s - k)\,\mathrm{d}k \\ &= \varphi(f) - \int_0^f \varphi'(k) \theta(k - s)\,\mathrm{d}k + \int_f^\infty \varphi'(k) \theta(s - k)\,\mathrm{d}k \\ &= \varphi(f) + \varphi'(f) (s - f) + \int_0^f \varphi''(k) (k - s)^+\,\mathrm{d}k + \int_f^\infty \varphi''(k) (s - k)^+\,\mathrm{d}k. \end{aligned}\]Thus,

\[ \varphi(S_T) = \varphi(f) + \varphi'(f) (S_T - f) + \int_0^f \varphi''(k) (k - S_T)^+ \mathrm{d}k + \int_f^\infty \varphi''(k) (S_T - k)^+ \mathrm{d}k. \]

With \(f = \Eof{S_T}\) and taking expectation on both sides, we end up

\[\begin{aligned} \E[\varphi(S_T)] &= \varphi(f) + \int_0^f \varphi''(k) P(k)\, \mathrm{d}k + \int_f^\infty \varphi''(k) C(k)\, \mathrm{d}k. \end{aligned}\]- The price of any European style contingent claim can be expressed in terms of strips of out-of-money European options.

Remark

Dirac delta function \(\delta\) is a distribution, not a function. It is defined by the property that for any continuous function \(f\), we have \[ \int_{-\infty}^\infty f(x) \delta(x - a)\,\mathrm{d}x = f(a). \]

Dirac delta function

Heaviside function \(\theta\) is defined as \(\theta(x) = 0\) for \(x < 0\) and \(\theta(x) = 1\) for \(x \geq 0\). It is the integral of the Dirac delta function, i.e., \(\theta'(x) = \delta(x)\).

严格定义: 令 \(\delta_1(x), \delta_2(x), ...\) 为一个连续实函数的序列. 若 \(\delta_n(x)\) 满足以下两个条件, 那么我们把该函数列称为狄拉克 \(\delta\) 函数 (列):

对所有性质良好 (例如在 \(x=0\) 连续) 的 \(f(x)\) , 都有 \[ \lim_{n \to \infty} \int_{-\infty}^\infty f(x) \delta_n(x)\,\mathrm{d}x = f(0). \]

Example - log contract

Consider the log contract \(\displaystyle \varphi(s) = \log s\). Since \(\displaystyle \varphi'(s) = \frac1s\) and \(\displaystyle \varphi''(s) = -\frac1{s^2}\), we obtain

\[ \log s = \log f + \frac{s - f}{f} - \int_0^f \frac{(k - s)^+}{k^2} \mathrm{d}k - \int_f^\infty \frac{(s - k)^+}{k^2} \mathrm{d}k. \]

Thus,

\[ \Eof{\log S_T} = \log f - \int_0^f \, \frac{P(k)}{k^2} \,\mathrm{d}k - \int_f^\infty\, \frac{C(k)}{k^2} \,\mathrm{d}k. \]

On the other hand, assume \(S_t\) satisfies the SDE under risk neutral probability with zero interest and dividend rates

\[ \frac{\mathrm{d}S_t}{S_t} = \sigma_t \mathrm{d}W_t, \]

by applying Ito’s formula to \(\log S_t\), we obtain

\[ \log S_T = \log S_0 + \int_0^T \sigma_t \, \mathrm{d}W_t - \frac{1}{2} \int_0^T \sigma_t^2 \, \mathrm{d}t. \]

It follows by taking expectation on both sides that

\[ \Eof{\log S_T} = \log S_0 - \frac12 \Eof{\int_0^T \sigma_t^2 \mathrm{d}t} \]

Compare the two identities we obtain

\[ \frac1T \Eof{\int_0^T \sigma_t^2 \mathrm{d}t} = \frac2T \int_0^f \, \frac{P(k)}{k^2} \,\mathrm{d}k + \frac2T \int_f^\infty\, \frac{C(k)}{k^2} \,\mathrm{d}k. \]

注: 这个式子的左端就是 VIX 的新的定义. “The new VIX squared approximates the conditional risk-neutral expectation of the annualized return variance over the next 30 calendar days.” (Carr and Wu 2004)

Note

- Modulo the diffusion process assumption on the underlying, the last relationship is model-free.

- VIX is calculated based on this formula with \(T\) equal to a month.

注: \(\Eof{(s-k)^+} = C(k)\), \(\Eof{(k-s)^+} = P(k)\). 这里的 \(C(k)\) 代表的是行权价为 \(k\) 的 call 期权的价格, 而 \(P(k)\) 代表的是行权价为 \(k\) 的 put 期权的价格.

Forward price \(F\) is defined as the price of a forward contract that delivers one unit of the underlying at time \(T\). It is given by \[ F = S e^{-(d-r)\tau} = S e^{-r\tau} e^{-d\tau}. \]

Here, \(S\) represents the current price of the underlying, \(d\) is the dividend yield, \(r\) is the risk-free interest rate, and \(\tau\) is the time to maturity in years.

How is VIX calculated?

VIX definition in the CBOE white paper:

\[\text{VIX}^2=\frac{2}{T}\,\sum_i\,\frac{\Delta K_i}{K_i^2}\, Q_i(K_i)\,-\,\frac{1}{T}\,\left[\frac{F}{K_0}-1\right]^2 \]

where \(Q_i\) is the price of the out-of-the-money option with strike \(K_i\) and \(K_0\) is the highest strike below the forward price \(F\). \(T\) is one month.

注: 在理论上, 积分是从执行价 \(k=0\) 一直走到 \(+\infty\), 以 \(F\) 作为“切点”来拼接看跌和看涨期权部分. 但实际操作中, 缺乏一个连续 \(k\) 的期权价格曲线, 必须离散化并使用最近的实际执行价 \(K_0\) 来近似 cutting price. 由于 \(K_0\) 不一定等于 \(F\), 就会产生一项偏差, 这项偏差正是: \[ \frac{1}{T}\,\left(\frac{F}{K_0}-1\right)^2 \]

Simple explanation of VIX formula is that it is a square root of weighted sum of out of the money SPX options.

Quotes by 于鹏

期权价格反应了当前市场的供需状况. 某个到日期的期权价格反应投资者对这段期间内市场波动的预期, 用真金白银报价出来的波动预期. 而与 in-the-money (实值) 期权比起来, 虚值期权没有内在价值, 只有时间价值. 也就是说虚值期权的价格“更纯粹”的反应了这种预期的价值. 那么用虚值期权来计算 VIX, 更契合其设计目的 (VIX is a measure of expected volatility calculated as ..) 还有一个地方也反应了这点, 没有 bid 报价的虚值期权也不会被列入计算之内, “Only SPX options quoted with non-zero bid prices are used in the VIX calculation”. 意味着没有市场需求的期权没有考虑进来的必要.

CBOE’s Volatility Index Mathematics Methodology:

The generalized formula used in the volatility calculation is:

\[ \sigma^2 = \frac{2}{T} \sum_{i} \frac{\Delta K_i}{K_i^2} e^{RT} Q(K_i) - \frac{1}{T} \left( \frac{F}{K_0} - 1 \right)^2 \]

where:

- \(\sigma\): Volatility index = \(\sigma \times 100\)

- \(T\): Time to expiration (in years), Number of minutes from time of calculation until expiration / Number of minutes in a 365-day year (365 x 1,440 = 525,600).

- \(F\): Option-implied forward price. It can be calculated by the intercept of Call-Put Parity’s OLS regression. Or it can be calculated by identifying the options strike price at which the absolute difference between the call price and the put price is smallest. And thus \(F = \text{Stike Price} + e^{RT} (\text{Call Price} - \text{Put Price})\).

- \(R\): Risk-free interest rate to expiration.

- \(K_0\): First strike equal to or otherwise immediately below \(F\).

- \(K_i\): Strike price of the \(i\)-th out-of-the-money option.

- A call if \(K_i > K_0\);

- A put if \(K_i < K_0\);

- both calls and puts if \(K_i = K_0\).

- \(\Delta K_i\): Interval between strike spreads.

- Highest OTM Strike \(K_i\): \(K_i - K_{i-1}\);

- Lowest OTM Strike \(K_i\): \(K_{i+1} - K_i\);

- Otherwise: \((K_{i+1} - K_{i-1})/2\).

- \(Q(K_i)\): Option price of the OTM option with strike \(K_i\). \(Q(K_0)\) is the average of the call and put prices at strike \(K_0\).

Download VIX data from yfinance

You may skip this part if you encounter an error.

start = '2007-01-01'

end = '2022-07-29'

vix = yf.download('^VIX', start=start, end=end)

vix = vix.drop('Volume', axis=1)

vixC:\Windows\Temp\ipykernel_3812\3558120957.py:3: FutureWarning: YF.download() has changed argument auto_adjust default to True

vix = yf.download('^VIX', start=start, end=end)

[*********************100%***********************] 1 of 1 completed| Price | Close | High | Low | Open |

|---|---|---|---|---|

| Ticker | ^VIX | ^VIX | ^VIX | ^VIX |

| Date | ||||

| 2007-01-03 | 12.040000 | 12.750000 | 11.530000 | 12.160000 |

| 2007-01-04 | 11.510000 | 12.420000 | 11.280000 | 12.400000 |

| 2007-01-05 | 12.140000 | 12.250000 | 11.680000 | 11.840000 |

| 2007-01-08 | 12.000000 | 12.830000 | 11.780000 | 12.480000 |

| 2007-01-09 | 11.910000 | 12.470000 | 11.690000 | 11.860000 |

| ... | ... | ... | ... | ... |

| 2022-07-22 | 23.030001 | 23.809999 | 22.410000 | 23.299999 |

| 2022-07-25 | 23.360001 | 24.570000 | 23.190001 | 24.330000 |

| 2022-07-26 | 24.690001 | 25.309999 | 23.820000 | 23.950001 |

| 2022-07-27 | 23.240000 | 24.410000 | 23.020000 | 24.270000 |

| 2022-07-28 | 22.330000 | 23.540001 | 22.219999 | 23.330000 |

3920 rows × 4 columns

plt.figure(figsize=(9, 6))

vix['Close'].plot(label='VIX')

#plt.plot(spx_vol*100, 'r-.', label='Historical Volatility')

plt.grid()

plt.legend();<Figure size 900x600 with 0 Axes>

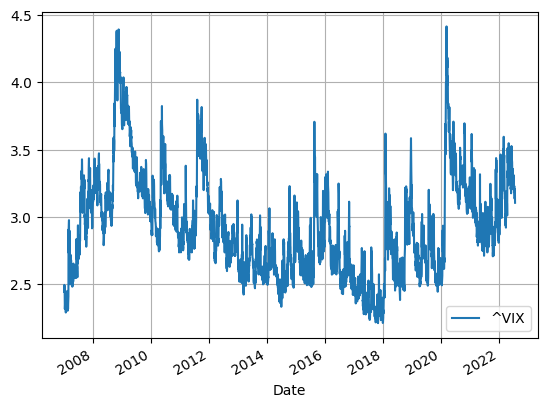

# plot log(vix)

plt.figure(figsize=(9, 6))

log(vix)['Close'].plot(label='log ViX')

plt.grid()

plt.legend();<Figure size 900x600 with 0 Axes>

Volatility derivatives

- variance swap

- volatility swap

- VIX futures

- VIX options

Variance swap

Quote from the Wikipage:

A variance swap is an over-the-counter financial derivative that allows one to speculate on or hedge risks associated with the magnitude of movement, i.e. volatility, of some underlying product, like an exchange rate , interest rate, or stock index.

One leg of the swap will pay an amount based upon the realized variance of the price changes of the underlying product. Conventionally, these price changes will be daily log returns, based upon the most commonly used closing price. The other leg of the swap will pay a fixed amount, which is the strike, quoted at the deal’s inception. Thus the net payoff to the counterparties will be the difference between these two and will be settled in cash at the expiration of the deal, though some cash payments will likely be made along the way by one or the other counterparty to maintain agreed upon margin.

In summary, a variance swap is a forward contract on realized (annualized) variance whose payoff function ideally is given by

\[ N \times \left(\frac1T \int_0^T \sigma_t^2 \mathrm{d}t - K \right) \]

where \(K\) is the strike and \(N\) denotes the notional.

Volatility swap

Quote from the Wikipage:

In finance, a volatility swap is a forward contract on the future realised volatility of a given underlying asset. Volatility swaps allow investors to trade the volatility of an asset directly, much as they would trade a price index.

The underlying is usually a foreign exchange (FX) rate (very liquid market) but could be as well a single name equity or index. However, the variance swap is preferred in the equity market because it can be replicated with a linear combination of options and a dynamic position in futures.